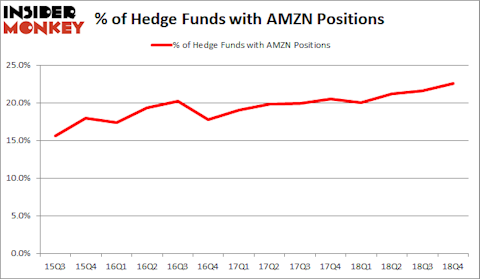

Amazon.com, Inc. (NASDAQ:AMZN) investors should pay attention to an increase in support from the world’s most elite money managers of late. AMZN was in 168 hedge funds’ portfolios at the end of December. There were 150 hedge funds in our database with AMZN holdings at the end of September. Our calculations also showed that AMZN is among the 30 most popular stocks among hedge funds. Actually hedge fund sentiment towards Amazon is currently at its all time high.

This is usually a very bullish signal. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and outperformed the SPY by nearly 14 percentage points in 2.5 months. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the key hedge fund action regarding Amazon.com, Inc. (NASDAQ:AMZN).

What have hedge funds been doing with Amazon.com, Inc. (NASDAQ:AMZN)?

Heading into the first quarter of 2019, a total of 168 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AMZN over the last 14 quarters. We wouldn’t be wrong to state that hedge fund sentiment towards Amazon is at an all-time high.

According to Insider Monkey’s hedge fund database, Citadel Investment Group, managed by Ken Griffin, holds the largest position in Amazon.com, Inc. (NASDAQ:AMZN). Citadel Investment Group has a $5.3931 billion call position in the stock, comprising 3% of its 13F portfolio. Coming in second is Ken Fisher of Fisher Asset Management, with a $2.4344 billion position; 3.3% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors with similar optimism encompass Boykin Curry’s Eagle Capital Management, Chase Coleman’s Tiger Global Management LLC and Stephen Mandel’s Lone Pine Capital.

As aggregate interest increased, some big names were leading the bulls’ herd. D1 Capital Partners, managed by Daniel Sundheim, assembled the most valuable position in Amazon.com, Inc. (NASDAQ:AMZN). D1 Capital Partners had $426.3 million invested in the company at the end of the quarter. Andrew Hahn’s Ursa Fund Management also initiated a $300.4 million position during the quarter. The other funds with brand new AMZN positions are Daniel S. Och’s OZ Management, Hari Hariharan’s NWI Management, and David Goel and Paul Ferri’s Matrix Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Amazon.com, Inc. (NASDAQ:AMZN) but similarly valued. We will take a look at Alphabet Inc (NASDAQ:GOOGL), Alphabet Inc (NASDAQ:GOOG), Berkshire Hathaway Inc. (NYSE:BRK-B), and Facebook Inc (NASDAQ:FB). All of these stocks’ market caps resemble AMZN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GOOGL | 146 | 12470388 | 9 |

| GOOG | 141 | 12831961 | 11 |

| BRK-B | 87 | 21379350 | 3 |

| FB | 161 | 14869125 | -3 |

| Average | 133.75 | 15387706 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 133.75 hedge funds with bullish positions and the average amount invested in these stocks was $15388 million. That figure was $19025 million in AMZN’s case. Facebook Inc (NASDAQ:FB) is the most popular stock in this table. On the other hand Berkshire Hathaway Inc. (NYSE:BRK-B) is the least popular one with only 87 bullish hedge fund positions. Compared to these stocks Amazon.com, Inc. (NASDAQ:AMZN) is more popular among hedge funds.

Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on Amazon as the stock returned 14.0% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.