We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Tidewater Inc. (NYSE:TDW).

Tidewater Inc. (NYSE:TDW) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 15 hedge funds’ portfolios at the end of June. At the end of this article we will also compare TDW to other stocks including EDENOR S.A. (NYSE:EDN), DHT Holdings Inc (NYSE:DHT), and Hecla Mining Company (NYSE:HL) to get a better sense of its popularity. Our calculations also showed that TDW isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the latest hedge fund action encompassing Tidewater Inc. (NYSE:TDW).

Hedge fund activity in Tidewater Inc. (NYSE:TDW)

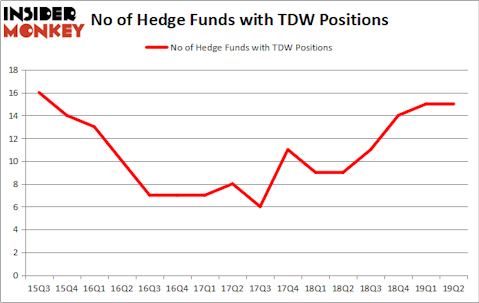

Heading into the third quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TDW over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Third Avenue Management, managed by Martin Whitman, holds the largest position in Tidewater Inc. (NYSE:TDW). Third Avenue Management has a $61.1 million position in the stock, comprising 5.1% of its 13F portfolio. The second most bullish fund manager is Raging Capital Management, led by William C. Martin, holding a $50.9 million position; 8.6% of its 13F portfolio is allocated to the company. Other peers that are bullish consist of Amit Wadhwaney’s Moerus Capital Management, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC and Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors.

Because Tidewater Inc. (NYSE:TDW) has witnessed falling interest from the smart money, it’s easy to see that there were a few fund managers that elected to cut their full holdings in the second quarter. At the top of the heap, Joel Greenblatt’s Gotham Asset Management dropped the biggest investment of all the hedgies tracked by Insider Monkey, totaling close to $0.5 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund sold off about $0.2 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Tidewater Inc. (NYSE:TDW) but similarly valued. These stocks are EDENOR S.A. (NYSE:EDN), DHT Holdings Inc (NYSE:DHT), Hecla Mining Company (NYSE:HL), and Sapiens International Corporation N.V. (NASDAQ:SPNS). This group of stocks’ market caps are closest to TDW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EDN | 4 | 3437 | -1 |

| DHT | 16 | 110442 | 0 |

| HL | 8 | 13607 | -1 |

| SPNS | 8 | 22769 | 1 |

| Average | 9 | 37564 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $223 million in TDW’s case. DHT Holdings Inc (NYSE:DHT) is the most popular stock in this table. On the other hand EDENOR S.A. (NYSE:EDN) is the least popular one with only 4 bullish hedge fund positions. Tidewater Inc. (NYSE:TDW) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TDW wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TDW were disappointed as the stock returned -35.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.