At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Is Tidewater Inc. (NYSE:TDW) ready to rally soon? Prominent investors are taking an optimistic view. The number of long hedge fund positions advanced by 1 in recent months. Our calculations also showed that TDW isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are assumed to be underperforming, outdated financial vehicles of yesteryear. While there are greater than 8000 funds trading today, Our researchers hone in on the masters of this group, approximately 750 funds. These hedge fund managers administer most of all hedge funds’ total capital, and by monitoring their highest performing equity investments, Insider Monkey has discovered a number of investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a glance at the recent hedge fund action surrounding Tidewater Inc. (NYSE:TDW).

How have hedgies been trading Tidewater Inc. (NYSE:TDW)?

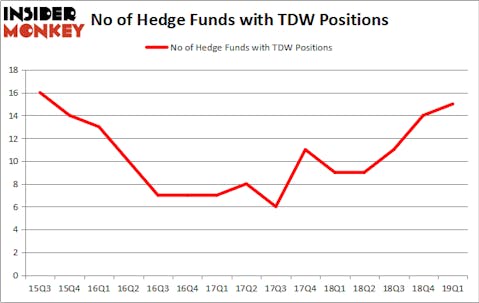

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TDW over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Third Avenue Management, managed by Martin Whitman, holds the number one position in Tidewater Inc. (NYSE:TDW). Third Avenue Management has a $57 million position in the stock, comprising 4.4% of its 13F portfolio. On Third Avenue Management’s heels is Raging Capital Management, managed by William C. Martin, which holds a $56.1 million position; the fund has 8.1% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish contain Amit Wadhwaney’s Moerus Capital Management, Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors and Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC.

Consequently, specific money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most outsized position in Tidewater Inc. (NYSE:TDW). Marshall Wace LLP had $0.5 million invested in the company at the end of the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Tidewater Inc. (NYSE:TDW). We will take a look at NorthStar Realty Europe Corp. (NYSE:NRE), Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (NYSE:EDN), Griffon Corporation (NYSE:GFF), and Tucows Inc. (NASDAQ:TCX). This group of stocks’ market caps are similar to TDW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NRE | 9 | 98233 | -4 |

| EDN | 5 | 12274 | -1 |

| GFF | 7 | 127227 | -7 |

| TCX | 10 | 65510 | 3 |

| Average | 7.75 | 75811 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $76 million. That figure was $216 million in TDW’s case. Tucows Inc. (NASDAQ:TCX) is the most popular stock in this table. On the other hand Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (NYSE:EDN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Tidewater Inc. (NYSE:TDW) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately TDW wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TDW were disappointed as the stock returned -1.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.