Tourbillon Capital Partners is a long/short equity hedge fund established by Jason Karp in 2013. Karp had previously worked for Steven Cohen’s SAC Capital and also served as co-CIO and partner at Carlson Capital. According to regulatory filings, Tourbillon Capital had approximately $5.66 billion in assets under management in the beginning of May 2016. At the end of the third quarter, the fund had an equity portfolio worth $4.9 billion, well diversified across a number of sectors. Technology and consumer discretionary stand out as they account for 20% of the portfolio each.

Insider Monkey likes to assess a fund manager’s stock picking ability by measuring the performance of equity bets on companies with a market capitalization of $1 billion and more. According to our analysis, 25 of Tourbillon’s stock picks heading into the third quarter qualified under our assumptions, posting a weighted average return of 11.49% in the period. In this article we’ll take a look at the adjustments made by Jason Karp and his team with regard to Expedia Inc (NASDAQ:EXPE), Post Holdings Inc (NYSE:POST), American Homes 4 Rent (NYSE:AMH), and Citrix Systems, Inc. (NASDAQ:CTXS).

Follow Jason Karp's Tourbillon Capital Partners

Online travel company Expedia Inc (NASDAQ:EXPE) is still one of Tourbillon Capital Partners’ major positions. During the third quarter, the fund cut its stake in the company by 38% to 1.92 million shares worth $223.6 million. Although Expedia Inc (NASDAQ:EXPE)’s stock spent most of the third quarter trending sideways, thanks to rallies in the beginning of July and at the end of September, the stock finished the quarter up by 10.1%. Heading into the third quarter of 2016, 67 funds tracked by Insider Monkey were bullish on this stock, an increase of 3% from one quarter earlier. According to our hedge fund database, PAR Capital Management, managed by Paul Reeder and Edward Shapiro, held the largest position in Expedia Inc (NASDAQ:EXPE), which was worth $695.9 million at the end of June. The second most bullish fund was Altimeter Capital Management, led by Brad Gerstner, holding a $478.1 million position. Some other professional money managers that held long positions encompassed Robert Pitts’s Steadfast Capital Management and Barry Rosenstein’s JANA Partners.

Follow Expedia Group Inc. (NASDAQ:EXPE)

Follow Expedia Group Inc. (NASDAQ:EXPE)

Receive real-time insider trading and news alerts

Post Holdings Inc (NYSE:POST) was on Jason Karp’s shopping list last quarter, as Tourbillon Capital’s stake in the company increased by 5% to 3.21 million shares valued at approximately $248 million. Meanwhile, Post Holdings Inc (NYSE:POST)’s stock fell by 6.7% during the same period. The number of funds from our database invested in the stock at the end of June rose by 18% over the quarter to 40. More specifically, Tourbillon Capital Partners was the largest shareholder of Post Holdings Inc (NYSE:POST) followed closely by Route One Investment Company, which amassed a stake valued at $234.7 million. Citadel Investment Group, Diamond Hill Capital, and Bridger Management also held valuable positions in the company.

Follow Post Holdings Inc. (NYSE:POST)

Follow Post Holdings Inc. (NYSE:POST)

Receive real-time insider trading and news alerts

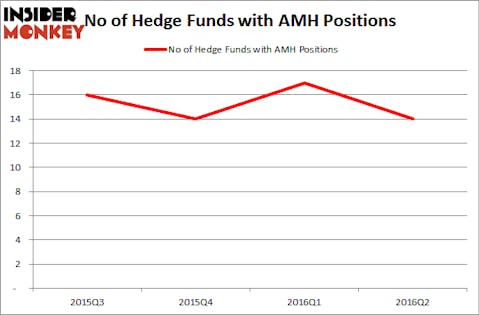

In American Homes 4 Rent (NYSE:AMH), Jason Karp and his team decided to reduce their position. Over the course of the third quarter, the stake was cut by 20% to 7.81 million shares valued at $169 million. Meanwhile, the stock appreciated by 5.9% between July and September. At the end of the second quarter, 14 funds followed by Insider Monkey were invested in American Homes 4 Rent (NYSE:AMH), a drop of 18% from the first quarter. According to our data, Tourbillon Capital Partners was the largest shareholder of American Homes 4 Rent (NYSE:AMH), followed by was AEW Capital Management, which amassed a stake valued at $66.8 million. Capital Growth Management, Forward Management, and Millennium Management also held valuable positions in the company.

Follow American Homes 4 Rent (NYSE:AMH)

Follow American Homes 4 Rent (NYSE:AMH)

Receive real-time insider trading and news alerts

Last but not least is Citrix Systems, Inc. (NASDAQ:CTXS), a provider of online software solutions. According to its latest 13F filing, Tourbillon Capital Partners had its entire position liquidated during the third quarter. The fund had held 1.18 million shares at the end of the previous quarter. After the solid rally from the second quarter, Citrix Systems, Inc. (NASDAQ:CTXS) went flat for most of the third quarter, managing a modest advance of 6.4%. Heading into the third quarter of 2016, 45 investors from our database held long positions in this stock, up by 13% from one quarter earlier. According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Paul Singer’s Elliott Management had the most valuable position in Citrix Systems, Inc. (NASDAQ:CTXS), worth close to $537.1 million at the end of June. Sitting at the No. 2 spot was Cliff Asness’ AQR Capital Management with a $191.6 million position. Remaining professional money managers that held long positions included Bain Capital’s Brookside Capital and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Follow Citrix Systems Inc (NASDAQ:CTXS)

Follow Citrix Systems Inc (NASDAQ:CTXS)

Receive real-time insider trading and news alerts

Disclosure: none.