There were 659 hedge funds in our system whose 13F portfolios consisted of at least five long positions in billion-dollar companies on June 30. Of those 659 funds, an impressive 627 of them delivered positive returns during the third-quarter from their long positions in those stocks, based on the size of those positions on June 30. All told, their long picks in billion-dollar companies averaged 8.3% returns for the quarter, well above the S&P 500 ETFs’ 3.3% figure. Nonetheless, hedge funds continue to disappoint their investors for the most part, as redemptions have hit the industry hard of late. That can be chalked up to their high fees and the underperformance on the short-side of their portfolios, which provide downside protection but have dragged down overall returns.

In the case of Brad Gerstner‘s Altimeter Capital Management, the fund’s 12 positions in companies that were worth $1 billion or more on June 30 delivered weighted average returns of 17.03% during the third quarter. A Boston-based hedge fund founded back in 2008 by Brad Gerstner, the fund’s focus is investing in the services sector, and its equity portfolio was worth $1.34 billion at the end of June. In this article we’ll take a look at its positions in Expedia Inc (NASDAQ:EXPE), United Continental Holdings Inc (NYSE:UAL), Tableau Software Inc (NYSE:DATA), and Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), and see how they performed.

It is important to note that our measurement of a fund’s stock-picking returns may be different from the fund’s actual returns, because we don’t include short positions and some other instruments. However, these returns can still be used to examine the success of the fund’s long investments (which is our focus at Insider Monkey). That being said, let’s examine the aforementioned four stock picks of Altimeter Capital Management.

First up, we have Expedia Inc (NASDAQ:EXPE), an online travel company. The fund made a smart investment move during the second quarter, boosting its stake in the company by 18%, reporting a position valued at $478.15 million at the end of June. The move was a smart one since the stock returned 10.1% over the next three months. That was important performance for the fund, as its stake in Expedia accounted for a whopping 35.60% of its equity portfolio’s value.

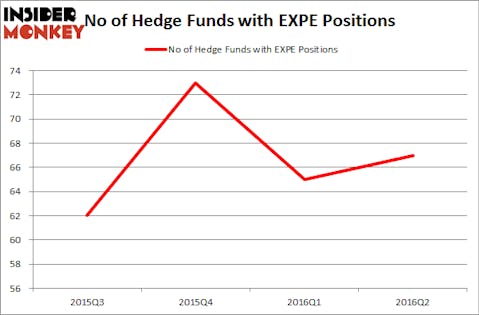

Some other smart money managers were also betting on this stock, as the number of bullish investors from our database increased by two in the second quarter, as at the end of June, there were 67 hedge funds with long positions in Expedia Inc (NASDAQ:EXPE). Among these funds, PAR Capital Management held the most valuable stake, which was worth $695.9 million. Moreover, Tourbillon Capital Partners, Steadfast Capital Management, and JANA Partners were also bullish on Expedia Inc (NASDAQ:EXPE).

Follow Expedia Group Inc. (NASDAQ:EXPE)

Follow Expedia Group Inc. (NASDAQ:EXPE)

Receive real-time insider trading and news alerts

Next in line is Altimeter Capital Management’s position in United Continental Holdings Inc (NYSE:UAL), which wasn’t changed during the second quarter, as the fund reported owning 11.51 million shares, which were valued at $472.34 million. The position accounted for 35.17% of its portfolio’s value and returned 27.9% during the third quarter. As both travel stocks have posted strong gains in Q4 as well, Altimeter could be poised for another strong quarter, depending on how it traded these equities during Q3. UAL has gained 14% in the fourth quarter.

At the end of June, a total of 57 of the hedge funds tracked by Insider Monkey were bullish on UAL, down by 7% from the previous quarter. Among these funds, PAR Capital Management again held the most valuable stake among the funds in our system, which was worth $668.7 million at the end of the second quarter. Furthermore, AQR Capital Management, GMT Capital, and Citadel Investment Group were also bullish on United Continental Holdings Inc (NYSE:UAL).

Follow United Airlines Holdings Inc. (NASDAQ:UAL)

Follow United Airlines Holdings Inc. (NASDAQ:UAL)

Receive real-time insider trading and news alerts

The third top pick of Altimeter Capital Management is a company that offers software products, as its name, Tableau Software Inc (NYSE:DATA), suggests. The fund also kept its position in the company unchanged from the first quarter, holding 1.45 million shares which were valued at $70.98 million at the end of June. The position paled in comparison to the fund’s top-2 picks, accounting for 5.29% of its portfolio’s value. In the third quarter, Tableau Software’s shares returned 13%, while on a year-to-date basis the stock has lost 50.14%.

Heading into the third quarter of 2016, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, same as in the previous quarter. The largest stake in Tableau Software Inc (NYSE:DATA) was held by Matrix Capital Management, which reported holding $267.8 million worth of stock at the end of June. It was followed by Cadian Capital with a $126.9 million position. Other investors bullish on the company included Brookside Capital and SRS Investment Management.

Follow Tableau Software Inc (NYSE:DATA)

Follow Tableau Software Inc (NYSE:DATA)

Receive real-time insider trading and news alerts

The last stock we are going to examine today is Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), which is a company that provides travel services in China. During the third quarter, the stock returned 13%. This is yet another company in which Altimeter Capital Management made no change to its position during the second quarter, leaving the fund’s stake at 1.29 million shares, which were worth $53.03 million and accounted for 3.95% of its portfolio’s value on June 30.

At Q2’s end, a total of 43 of the hedge funds in our database were long this stock, a 36% slide from the previous quarter. Among these funds, Fisher Asset Management held the most valuable stake in Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), which was worth $410.1 million at the end of the second quarter. On the second spot was Hillhouse Capital Management which amassed $333.4 million worth of shares. Moreover, Viking Global, Tourbillon Capital Partners, and OZ Management were also bullish on Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP).

Follow Trip.com Group Limited (NASDAQ:TCOM)

Follow Trip.com Group Limited (NASDAQ:TCOM)

Receive real-time insider trading and news alerts

Disclosure: None