Does The Allstate Corporation (NYSE:ALL) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

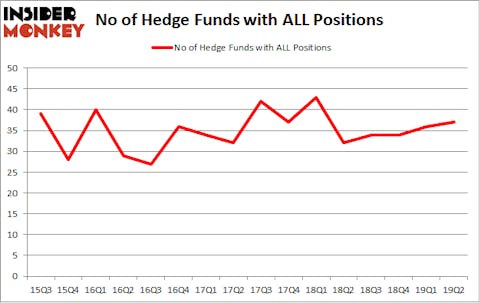

The Allstate Corporation (NYSE:ALL) investors should pay attention to an increase in activity from the world’s largest hedge funds lately. ALL was in 37 hedge funds’ portfolios at the end of the second quarter of 2019. There were 36 hedge funds in our database with ALL holdings at the end of the previous quarter. Our calculations also showed that ALL isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are viewed as underperforming, old financial tools of years past. While there are more than 8000 funds in operation at present, Our experts hone in on the elite of this club, approximately 750 funds. Most estimates calculate that this group of people watch over the majority of all hedge funds’ total capital, and by paying attention to their highest performing investments, Insider Monkey has deciphered numerous investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Noam Gottesman, GLG Partners

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the latest hedge fund action surrounding The Allstate Corporation (NYSE:ALL).

How have hedgies been trading The Allstate Corporation (NYSE:ALL)?

Heading into the third quarter of 2019, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from one quarter earlier. On the other hand, there were a total of 32 hedge funds with a bullish position in ALL a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in The Allstate Corporation (NYSE:ALL), which was worth $643.6 million at the end of the second quarter. On the second spot was GLG Partners which amassed $234 million worth of shares. Moreover, Two Sigma Advisors, Citadel Investment Group, and D E Shaw were also bullish on The Allstate Corporation (NYSE:ALL), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers have been driving this bullishness. Alyeska Investment Group, managed by Anand Parekh, created the most valuable position in The Allstate Corporation (NYSE:ALL). Alyeska Investment Group had $56.4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $10.9 million investment in the stock during the quarter. The following funds were also among the new ALL investors: Mario Gabelli’s GAMCO Investors, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Gregg Moskowitz’s Interval Partners.

Let’s also examine hedge fund activity in other stocks similar to The Allstate Corporation (NYSE:ALL). We will take a look at The Royal Bank of Scotland Group plc (NYSE:RBS), NetEase, Inc (NASDAQ:NTES), Melco Resorts & Entertainment Limited (NASDAQ:MLCO), and The Williams Companies, Inc. (NYSE:WMB). All of these stocks’ market caps are closest to ALL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBS | 6 | 33528 | 3 |

| NTES | 34 | 3764631 | 4 |

| MLCO | 22 | 494344 | 0 |

| WMB | 34 | 1075157 | 2 |

| Average | 24 | 1341915 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $1342 million. That figure was $1898 million in ALL’s case. NetEase, Inc (NASDAQ:NTES) is the most popular stock in this table. On the other hand The Royal Bank of Scotland Group plc (NYSE:RBS) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks The Allstate Corporation (NYSE:ALL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on ALL as the stock returned 7.4% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.