Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is SunOpta, Inc. (NASDAQ:STKL), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

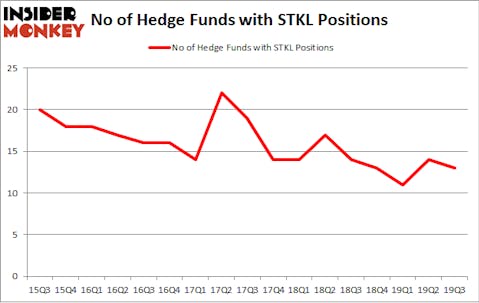

SunOpta, Inc. (NASDAQ:STKL) has experienced a decrease in activity from the world’s largest hedge funds recently. STKL was in 13 hedge funds’ portfolios at the end of the third quarter of 2019. There were 14 hedge funds in our database with STKL positions at the end of the previous quarter. Our calculations also showed that STKL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of tools investors employ to appraise publicly traded companies. A duo of the less utilized tools are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the broader indices by a superb amount (see the details here).

Philip Hempleman of Ardsley Partners

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the latest hedge fund action regarding SunOpta, Inc. (NASDAQ:STKL).

What does smart money think about SunOpta, Inc. (NASDAQ:STKL)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the second quarter of 2019. On the other hand, there were a total of 14 hedge funds with a bullish position in STKL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in SunOpta, Inc. (NASDAQ:STKL) was held by Engaged Capital, which reported holding $15.7 million worth of stock at the end of September. It was followed by Ardsley Partners with a $15.6 million position. Other investors bullish on the company included Oaktree Capital Management, Point72 Asset Management, and Royce & Associates. In terms of the portfolio weights assigned to each position Ardsley Partners allocated the biggest weight to SunOpta, Inc. (NASDAQ:STKL), around 3.5% of its 13F portfolio. Engaged Capital is also relatively very bullish on the stock, dishing out 2.13 percent of its 13F equity portfolio to STKL.

Since SunOpta, Inc. (NASDAQ:STKL) has faced a decline in interest from the smart money, we can see that there were a few fund managers that elected to cut their entire stakes by the end of the third quarter. Intriguingly, Paul Tudor Jones’s Tudor Investment Corp dropped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $0.2 million in stock, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital was right behind this move, as the fund sold off about $0 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to SunOpta, Inc. (NASDAQ:STKL). These stocks are Olympic Steel, Inc. (NASDAQ:ZEUS), Vitamin Shoppe Inc (NYSE:VSI), Marrone Bio Innovations Inc (NASDAQ:MBII), and First United Corporation (NASDAQ:FUNC). This group of stocks’ market valuations are similar to STKL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZEUS | 7 | 3501 | -2 |

| VSI | 12 | 38820 | 1 |

| MBII | 2 | 14993 | -1 |

| FUNC | 6 | 16016 | 0 |

| Average | 6.75 | 18333 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $63 million in STKL’s case. Vitamin Shoppe Inc (NYSE:VSI) is the most popular stock in this table. On the other hand Marrone Bio Innovations Inc (NASDAQ:MBII) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks SunOpta, Inc. (NASDAQ:STKL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on STKL as the stock returned 61.1% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.