Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Steris Plc (NYSE:STE) and compare its performance to hedge funds’ consensus picks in 2019.

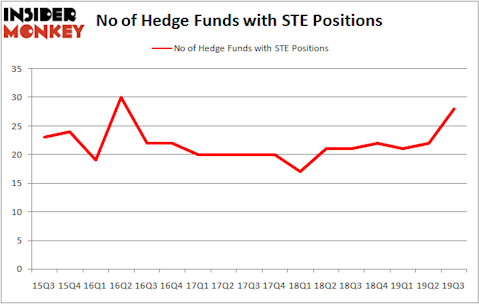

Is Steris Plc (NYSE:STE) a first-rate investment today? Investors who are in the know are becoming hopeful. The number of bullish hedge fund bets rose by 6 lately. Our calculations also showed that STE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the eyes of most investors, hedge funds are perceived as unimportant, outdated financial vehicles of years past. While there are greater than 8000 funds trading at present, Our researchers hone in on the upper echelon of this club, about 750 funds. These hedge fund managers shepherd the majority of the smart money’s total asset base, and by paying attention to their first-class picks, Insider Monkey has figured out various investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example one of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind we’re going to check out the recent hedge fund action encompassing Steris Plc (NYSE:STE).

What have hedge funds been doing with Steris Plc (NYSE:STE)?

Heading into the fourth quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from one quarter earlier. On the other hand, there were a total of 21 hedge funds with a bullish position in STE a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Steris Plc (NYSE:STE), with a stake worth $155 million reported as of the end of September. Trailing Fisher Asset Management was Citadel Investment Group, which amassed a stake valued at $27.5 million. GLG Partners, Renaissance Technologies, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Welch Capital Partners allocated the biggest weight to Steris Plc (NYSE:STE), around 1.42% of its 13F portfolio. Algert Coldiron Investors is also relatively very bullish on the stock, earmarking 0.85 percent of its 13F equity portfolio to STE.

Now, some big names have jumped into Steris Plc (NYSE:STE) headfirst. Renaissance Technologies established the most outsized position in Steris Plc (NYSE:STE). Renaissance Technologies had $26.2 million invested in the company at the end of the quarter. Robert Joseph Caruso’s Select Equity Group also made a $19.6 million investment in the stock during the quarter. The following funds were also among the new STE investors: David E. Shaw’s D E Shaw, Israel Englander’s Millennium Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Steris Plc (NYSE:STE) but similarly valued. These stocks are Paycom Software Inc (NYSE:PAYC), Liberty Global Plc (NASDAQ:LBTYK), Fidelity National Financial Inc (NYSE:FNF), and Equity Lifestyle Properties, Inc. (NYSE:ELS). This group of stocks’ market valuations are similar to STE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAYC | 31 | 413981 | 7 |

| LBTYK | 38 | 3404866 | 4 |

| FNF | 28 | 340609 | -1 |

| ELS | 19 | 521910 | 1 |

| Average | 29 | 1170342 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1170 million. That figure was $389 million in STE’s case. Liberty Global Plc (NASDAQ:LBTYK) is the most popular stock in this table. On the other hand Equity Lifestyle Properties, Inc. (NYSE:ELS) is the least popular one with only 19 bullish hedge fund positions. Steris Plc (NYSE:STE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on STE as the stock returned 43.2% in 2019 through December 23rd and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.