You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

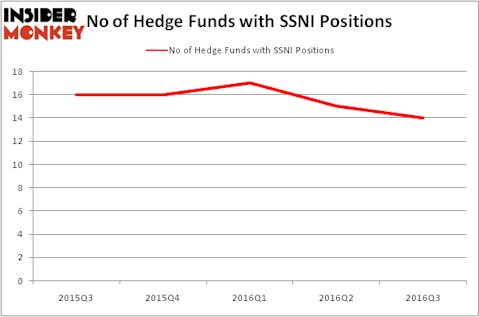

Silver Spring Networks Inc (NYSE:SSNI) was in 14 hedge funds’ portfolios at the end of the third quarter of 2016. SSNI has seen a decrease in enthusiasm from smart money of late. There were 15 hedge funds in our database with SSNI holdings at the end of the previous quarter. At the end of this article we will also compare SSNI to other stocks including SPX Corporation (NYSE:SPXC), Five9 Inc (NASDAQ:FIVN), and Hortonworks Inc (NASDAQ:HDP) to get a better sense of its popularity.

Follow Itron Networked Solutions Inc. (NYSE:SSNI)

Follow Itron Networked Solutions Inc. (NYSE:SSNI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bluebay/Shutterstock.com

With all of this in mind, let’s view the key action regarding Silver Spring Networks Inc (NYSE:SSNI).

What have hedge funds been doing with Silver Spring Networks Inc (NYSE:SSNI)?

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in SSNI at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Electron Capital Partners, led by Jos Shaver, holds the most valuable position in Silver Spring Networks Inc (NYSE:SSNI). Electron Capital Partners has a $6.2 million position in the stock, comprising 1.4% of its 13F portfolio. Coming in second is Royce & Associates, led by Chuck Royce, holding a $5.6 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers that are bullish comprise Philip Hempleman’s Ardsley Partners, Jim Simons’s Renaissance Technologies and Thomas E. Claugus’s GMT Capital. We should note that Electron Capital Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Silver Spring Networks Inc (NYSE:SSNI) has sustained declining sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of funds that decided to sell off their full holdings in the third quarter. It’s worth mentioning that Glenn Russell Dubin’s Highbridge Capital Management dropped the largest position of all the hedgies watched by Insider Monkey, worth close to $0.5 million in stock. David Costen Haley’s fund, HBK Investments, also dumped its stock, about $0.4 million worth.

Let’s go over hedge fund activity in other stocks similar to Silver Spring Networks Inc (NYSE:SSNI). These stocks are SPX Corporation (NYSE:SPXC), Five9 Inc (NASDAQ:FIVN), Hortonworks Inc (NASDAQ:HDP), and Seacoast Banking Corporation of Florida (NASDAQ:SBCF). All of these stocks’ market caps are similar to SSNI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPXC | 18 | 108570 | -3 |

| FIVN | 23 | 116555 | 7 |

| HDP | 14 | 91351 | 4 |

| SBCF | 14 | 80125 | 1 |

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $26 million in SSNI’s case. Five9 Inc (NASDAQ:FIVN) is the most popular stock in this table. On the other hand Hortonworks Inc (NASDAQ:HDP) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Silver Spring Networks Inc (NYSE:SSNI) is even less popular than HDP. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Top Online Clothing Retailers In The World

Most Educated Countries In The World

Most Expensive Furniture Stores

Disclosure: None