The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Xilinx, Inc. (NASDAQ:XLNX).

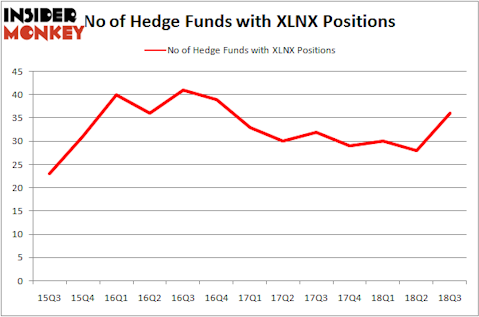

Is Xilinx, Inc. (NASDAQ:XLNX) a buy, sell, or hold? The smart money is in an optimistic mood. The number of bullish hedge fund bets went up by 8 recently. Our calculations also showed that XLNX isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of methods shareholders use to value publicly traded companies. A pair of the less known methods are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite money managers can outperform the broader indices by a superb margin (see the details here).

We’re going to take a peek at the latest hedge fund action encompassing Xilinx, Inc. (NASDAQ:XLNX).

What have hedge funds been doing with Xilinx, Inc. (NASDAQ:XLNX)?

At Q3’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards XLNX over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Blue Harbour Group, managed by Clifton S. Robbins, holds the largest position in Xilinx, Inc. (NASDAQ:XLNX). Blue Harbour Group has a $240.3 million position in the stock, comprising 11.1% of its 13F portfolio. Coming in second is Alkeon Capital Management, managed by Panayotis Takis Sparaggis, which holds a $212.1 million position; 1% of its 13F portfolio is allocated to the company. Some other members of the smart money that are bullish contain D. E. Shaw’s D E Shaw, Josh Resnick’s Jericho Capital Asset Management and Brandon Haley’s Holocene Advisors.

As one would reasonably expect, key money managers have been driving this bullishness. Jericho Capital Asset Management, managed by Josh Resnick, initiated the biggest position in Xilinx, Inc. (NASDAQ:XLNX). Jericho Capital Asset Management had $140 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $30.5 million investment in the stock during the quarter. The following funds were also among the new XLNX investors: Andrew Sandler’s Sandler Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Israel Englander’s Millennium Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Xilinx, Inc. (NASDAQ:XLNX) but similarly valued. These stocks are Energy Transfer Equity, L.P. (NYSE:ETE), ABIOMED, Inc. (NASDAQ:ABMD), Freeport-McMoRan Inc. (NYSE:FCX), and Global Payments Inc (NYSE:GPN). This group of stocks’ market valuations match XLNX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETE | 22 | 400005 | 6 |

| ABMD | 22 | 1750748 | -2 |

| FCX | 47 | 2251355 | 5 |

| GPN | 26 | 443182 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.21 billion. That figure was $1.52 billion in XLNX’s case. Freeport-McMoRan Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand Energy Transfer Equity, L.P. (NYSE:ETE) is the least popular one with only 22 bullish hedge fund positions. Xilinx, Inc. (NASDAQ:XLNX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FCX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.