At Insider Monkey we follow around 740 of the top investors and even though many of them underperformed the raging bull market, the history teaches us that over the long-run they still manage to beat the market after adjusting for risk, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following their best picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

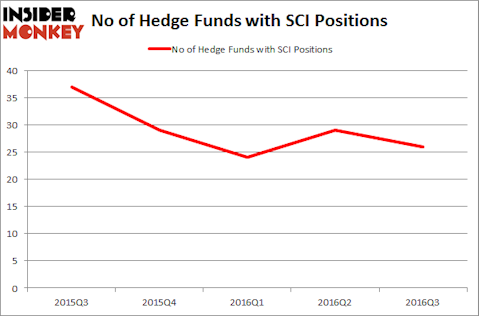

Is Service Corporation International (NYSE:SCI) going to take off soon? The best stock pickers seem to be turning less bullish. The number of positions held by funds in our database fell by three last quarter. At the end of this article we will also compare SCI to other stocks including United Therapeutics Corporation (NASDAQ:UTHR), ON Semiconductor Corp (NASDAQ:ON), and PTC Inc (NASDAQ:PTC) to get a better sense of its popularity.

Follow Service Corp International (NYSE:SCI)

Follow Service Corp International (NYSE:SCI)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Kzenon/Shutterstock.com

Now, we’re going to take a look at the new action encompassing Service Corporation International (NYSE:SCI).

Hedge fund activity in Service Corporation International (NYSE:SCI)

At the end of September, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on Service Corporation International (NYSE:SCI), down by 10% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in SCI heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Curtis Macnguyen’s Ivory Capital (Investment Mgmt) has the biggest position in Service Corporation International (NYSE:SCI), worth close to $77.3 million, amounting to 2.2% of its total 13F portfolio. Sitting at the No. 2 spot is Joshua Friedman and Mitchell Julis’ Canyon Capital Advisors, with a $67.5 million position; the fund has 2.5% of its 13F portfolio invested in the stock. Remaining peers that are bullish include Steve Cohen’s Point72 Asset Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and Jason Karp’s Tourbillon Capital Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.