Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards Enbridge Inc (NYSE:ENB) to find out whether there were any major changes in hedge funds’ views.

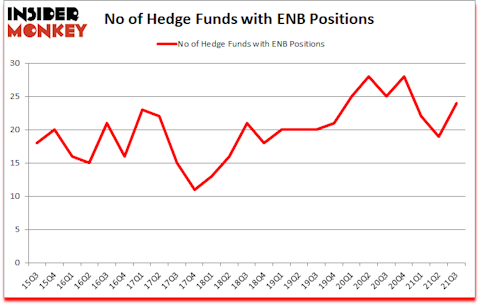

Enbridge Inc (NYSE:ENB) was in 24 hedge funds’ portfolios at the end of September. The all time high for this statistic is 28. ENB has seen an increase in enthusiasm from smart money in recent months. There were 19 hedge funds in our database with ENB holdings at the end of June. Our calculations also showed that ENB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

Peter Rathjens of Arrowstreet Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind let’s take a look at the key hedge fund action regarding Enbridge Inc (NYSE:ENB).

Do Hedge Funds Think ENB Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ENB over the last 25 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Enbridge Inc (NYSE:ENB), which was worth $47.4 million at the end of the third quarter. On the second spot was Arrowstreet Capital which amassed $33.3 million worth of shares. Millennium Management, Galibier Capital Management, and Point72 Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Heronetta Management allocated the biggest weight to Enbridge Inc (NYSE:ENB), around 5.92% of its 13F portfolio. Galibier Capital Management is also relatively very bullish on the stock, designating 4.28 percent of its 13F equity portfolio to ENB.

As aggregate interest increased, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, assembled the most valuable call position in Enbridge Inc (NYSE:ENB). Millennium Management had $47.4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $33.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Steve Pattyn’s Yaupon Capital, and McKinley Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Enbridge Inc (NYSE:ENB) but similarly valued. These stocks are Lam Research Corporation (NASDAQ:LRCX), Micron Technology, Inc. (NASDAQ:MU), Dell Technologies Inc. (NYSE:DELL), The TJX Companies, Inc. (NYSE:TJX), Truist Financial Corporation (NYSE:TFC), HCA Healthcare Inc (NYSE:HCA), and Zoom Video Communications, Inc. (NASDAQ:ZM). This group of stocks’ market caps resemble ENB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LRCX | 47 | 3519311 | -11 |

| MU | 63 | 3841359 | -24 |

| DELL | 60 | 6142951 | -2 |

| TJX | 63 | 2330294 | 7 |

| TFC | 34 | 275906 | -5 |

| HCA | 72 | 3309822 | 12 |

| ZM | 56 | 6003836 | -3 |

| Average | 56.4 | 3631926 | -3.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 56.4 hedge funds with bullish positions and the average amount invested in these stocks was $3632 million. That figure was $211 million in ENB’s case. HCA Healthcare Inc (NYSE:HCA) is the most popular stock in this table. On the other hand Truist Financial Corporation (NYSE:TFC) is the least popular one with only 34 bullish hedge fund positions. Compared to these stocks Enbridge Inc (NYSE:ENB) is even less popular than TFC. Our overall hedge fund sentiment score for ENB is 35.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds dodged a bullet by taking a bearish stance towards ENB. Our calculations showed that the top 5 most popular hedge fund stocks returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th but managed to beat the market again by 5.1 percentage points. Unfortunately ENB wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was very bearish); ENB investors were disappointed as the stock returned -3.1% since the end of the third quarter (through 12/9) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Enbridge Inc (NYSE:ENB)

Follow Enbridge Inc (NYSE:ENB)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Renewable Energy Companies and Stocks

- 20 Best Countries To Invest In Real Estate

- 12 Best Ecommerce Stocks to Invest In

Disclosure: None. This article was originally published at Insider Monkey.