Is Schlumberger Limited. (NYSE:SLB) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

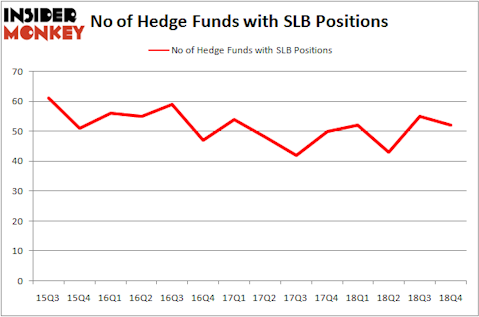

Schlumberger Limited. (NYSE:SLB) has seen a decrease in support from the world’s most elite money managers recently. Our calculations also showed that SLB isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s review the latest hedge fund action encompassing Schlumberger Limited. (NYSE:SLB).

Hedge fund activity in Schlumberger Limited. (NYSE:SLB)

At Q4’s end, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the previous quarter. On the other hand, there were a total of 52 hedge funds with a bullish position in SLB a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the largest position in Schlumberger Limited. (NYSE:SLB). D E Shaw has a $366.4 million position in the stock, comprising 0.5% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, managed by Jim Simons, which holds a $303.6 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Remaining peers that hold long positions include John Overdeck and David Siegel’s Two Sigma Advisors, Ken Fisher’s Fisher Asset Management and Charles de Vaulx’s International Value Advisers.

Due to the fact that Schlumberger Limited. (NYSE:SLB) has experienced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of money managers that decided to sell off their positions entirely heading into Q3. At the top of the heap, John Brennan’s Sirios Capital Management dumped the biggest investment of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $29.1 million in stock, and Alec Litowitz and Ross Laser’s Magnetar Capital was right behind this move, as the fund said goodbye to about $28.6 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 3 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Schlumberger Limited. (NYSE:SLB). We will take a look at Boston Scientific Corporation (NYSE:BSX), Deere & Company (NYSE:DE), General Motors Company (NYSE:GM), and The Estee Lauder Companies Inc (NYSE:EL). This group of stocks’ market valuations are similar to SLB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSX | 46 | 1700622 | 1 |

| DE | 47 | 2093476 | 10 |

| GM | 60 | 5275128 | -1 |

| EL | 33 | 1159461 | -3 |

| Average | 46.5 | 2557172 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 46.5 hedge funds with bullish positions and the average amount invested in these stocks was $2557 million. That figure was $1949 million in SLB’s case. General Motors Company (NYSE:GM) is the most popular stock in this table. On the other hand The Estee Lauder Companies Inc (NYSE:EL) is the least popular one with only 33 bullish hedge fund positions. Schlumberger Limited. (NYSE:SLB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on SLB, though not to the same extent, as the stock returned 18.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.