Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

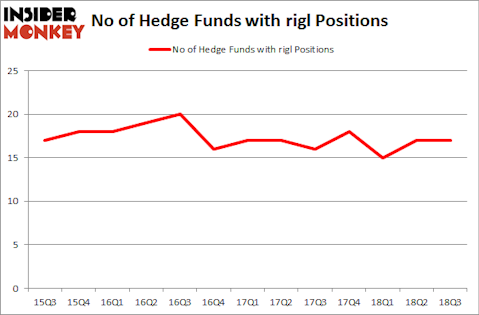

Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of September. At the end of this article we will also compare RIGL to other stocks including EMC Insurance Group Inc. (NASDAQ:EMCI), Gores Holdings II, Inc. (NYSE:GSHT), and Independence Holding Company (NYSE:IHC) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a glance at the recent hedge fund action surrounding Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL).

Hedge fund activity in Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL)

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, representing no change from the previous quarter. Below, you can check out the change in hedge fund sentiment towards RIGL over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) was held by Millennium Management, which reported holding $24.5 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $17.8 million position. Other investors bullish on the company included Tamarack Capital Management, Rock Springs Capital Management, and Palo Alto Investors.

Due to the fact that Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there were a few funds that elected to cut their full holdings by the end of the third quarter. At the top of the heap, Jeffrey Jay and David Kroin’s Great Point Partners sold off the largest investment of all the hedgies tracked by Insider Monkey, worth an estimated $9.6 million in stock. Julian Baker and Felix Baker’s fund, Baker Bros. Advisors, also sold off its stock, about $2.9 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) but similarly valued. These stocks are EMC Insurance Group Inc. (NASDAQ:EMCI), Gores Holdings II, Inc. (NYSE:GSHT), Independence Holding Company (NYSE:IHC), and NanoString Technologies Inc (NASDAQ:NSTG). All of these stocks’ market caps resemble RIGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EMCI | 2 | 8294 | 1 |

| GSHT | 17 | 177691 | 1 |

| IHC | 4 | 15381 | 0 |

| NSTG | 16 | 120272 | 5 |

| Average | 9.75 | 80410 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $99 million in RIGL’s case. Gores Holdings II, Inc. (NYSE:GSHT) is the most popular stock in this table. On the other hand EMC Insurance Group Inc. (NASDAQ:EMCI) is the least popular one with only 2 bullish hedge fund positions. Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GSHT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.