Founded in 1975 and based in Redmond, Washington, Microsoft Corporation (NASDAQ:MSFT) develops, licenses and supports a wide range of products and services related to computing.

The company’s products include operating systems, server applications, productivity applications and business solutions, desktop and server management tools, software development tools, video games, and online advertising. MSFT also designs, manufactures, and sells hardware, including gaming consoles and PC hardware products.

Northfoto / Shutterstock.com

MSFT is a Dividend Contender with a streak of 15 years of dividend increases. It pays quarterly dividends in March, June, September, and December. The current dividend is 39¢ per share, so MSFT yields 2.49% at the recent share price of $62.74.

MSFT has an impressive DGR (dividend growth rate). The stock’s 10-year DGR is 14.8%, while its 5-year, 3-year, and 1-year DGR’s are 16.7%, 14.9%, and 14%, respectively.

Background

As mentioned previously, I’m taking more consolidation actions and bringing the holdings of four additional IRAs we own into the DivGro fold. When completed, DivGro will be distributed over five different accounts, one trust account at Interactive Brokers and four IRAs at FolioInvesting.

The first action I’m reporting is transferring my IRA from Wells Fargo to FolioInvesting. This is a traditional IRA opened in April 2008. I’m retaining two holdings, Wal-Mart Stores Inc (NYSE:WMT) and MSFT, and transferring the remaining account value in cash.

The goal of this post is to create a record of past transactions and dividends received for the MSFT position. I’ll also share my reasons for holding onto this MSFT position. See this article for the reasons I’m retaining my WMT position.

Transactions

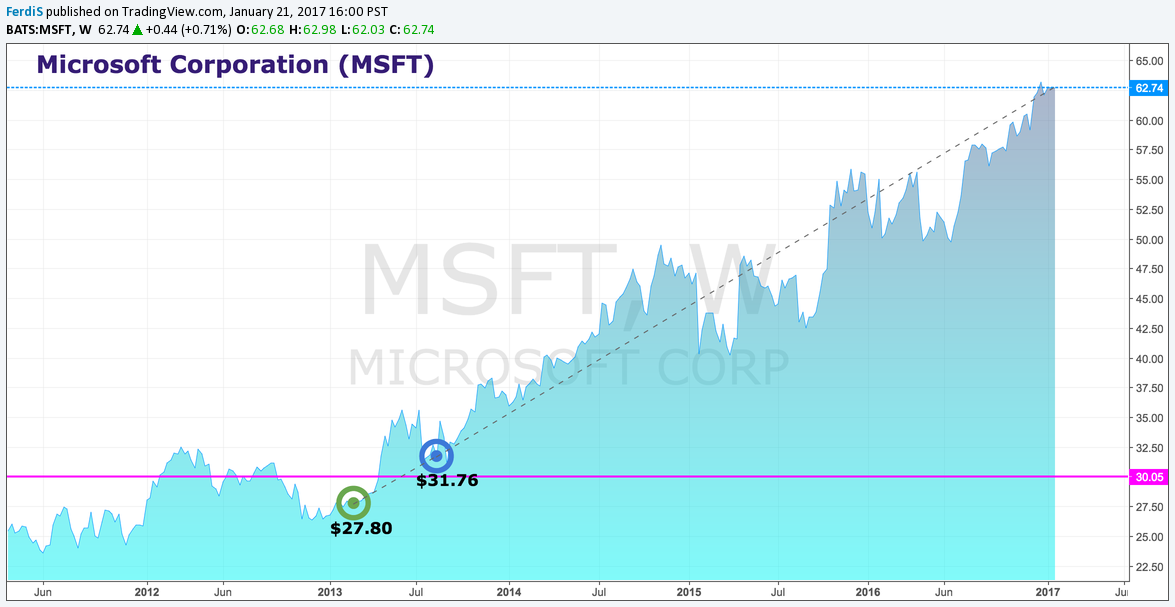

I bought 60 shares of MSFT in February 2013 at an initial yield on cost (YoC) of 3.31%. Since my purchase, the total dividends received is $277, for a payout ratio of 16.6%:

| 2013-02-28 | Bought 60 shares of MSFT at $27.80 per share: | $ | 1,668.00 |

| 2013-06-13 | Dividend on 60 shares at 23¢ per share: | $ | 13.80 |

| 2013-09-12 | Dividend on 60 shares at 23¢ per share: | $ | 13.80 |

| 2013-12-12 | Dividend on 60 shares at 28¢ per share: | $ | 16.80 |

| 2014-03-13 | Dividend on 60 shares at 28¢ per share: | $ | 16.80 |

| 2014-06-12 | Dividend on 60 shares at 28¢ per share: | $ | 16.80 |

| 2014-09-11 | Dividend on 60 shares at 28¢ per share: | $ | 16.80 |

| 2014-12-11 | Dividend on 60 shares at 31¢ per share: | $ | 18.60 |

| 2015-03-12 | Dividend on 60 shares at 31¢ per share: | $ | 18.60 |

| 2015-06-11 | Dividend on 60 shares at 31¢ per share: | $ | 18.60 |

| 2015-09-10 | Dividend on 60 shares at 31¢ per share: | $ | 18.60 |

| 2015-12-10 | Dividend on 60 shares at 36¢ per share: | $ | 21.60 |

| 2016-03-10 | Dividend on 60 shares at 36¢ per share: | $ | 21.60 |

| 2016-06-09 | Dividend on 60 shares at 36¢ per share: | $ | 21.60 |

| 2016-09-08 | Dividend on 60 shares at 36¢ per share: | $ | 21.60 |

| 2016-12-08 | Dividend on 60 shares at 39¢ per share: | $ | 23.40 |

| | __ | ||

| Total capital invested: | $ | 1,668.00 | |

| Total dividends received: | $ | 277.00 | |

| Commissions/fees/taxes: | $ | 0.00 |

With this transfer, DivGro’s projected annual dividend income (PADI) increases by $93.60 and I’m adding $277 in past dividends to DivGro’s total dividend income.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

After adding these shares to my existing MSFT position, I now own 140 shares at an average cost basis of $30.06, while the average YoC of these shares is 5.19%.

|

|

MSFT is performing very well and is DivGro’s 7th home run (1) stock. I call stocks with total returns that exceed my initial investment home runs.

Fair Value Estimates

My fair value estimate of MSFT is $57.82.

In comparison, Morningstar’s fair value estimate is $63.00, Finbox.io’s fair value estimate is $58.12, and Tipranks’ average price target is $68.30. S&P Capital IQ’s fair value calculation is $59.90.

Finbox.io presents a complete breakdown of its fair value estimate as well as range visualizers, not only for its estimates based on 12 different models, but also for Wall Street analysts’ targets and the stock’s 52-week trading range (see below, left).

I like Simply Wall St’s snowflake graphic, which presents a visual summary of a stock’s fundamentals and investment profile. You can read more about the company’s analysis model at Github.

| |  |

I also use F.A.S.T. Graphs, a fundamentals analysis tool that correlates earnings and market price. In the following 10-year chart for Microsoft Corporation (NASDAQ:MSFT), it is clear that the stock is trading at a premium, as the price line (black) has moved well above the correlated earnings line (orange). Two years of future earnings estimates are included, indicating a price target of $48.60 by June 2018.

Ratings and Rankings

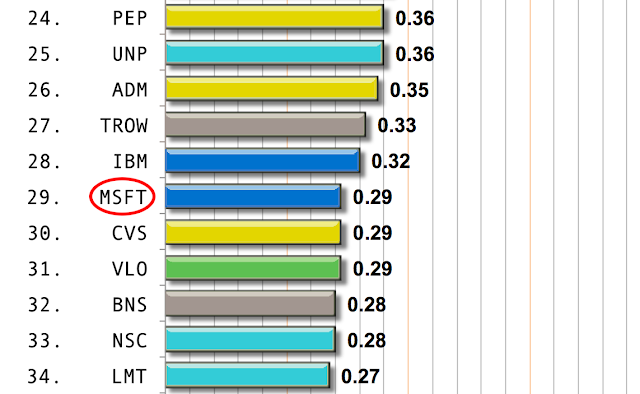

Recently, I wrote two articles presenting the top holdings of dividend ETFs and the top holdings of dividend growth bloggers (2017 edition). MSFT is the ranked #14 among dividend stocks held in dividend ETFs and is ranked #29 among dividend growth stocks held by dividend growth bloggers:

|  |

| MSFT ranked #14 | MSFT ranked #29 |

In my stock analyses, I reference ratings and rankings of several online sources, including those I’m subscribed to. See my Ratings (3) page for descriptions of these systems.

Here are updated ratings and rankings for Microsoft Corporation (NASDAQ:MSFT) (as of 21 January 2017):

†VGM Style: Value Growth Momentum and combined VGM score