We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Prospect Capital Corporation (NASDAQ:PSEC) based on that data.

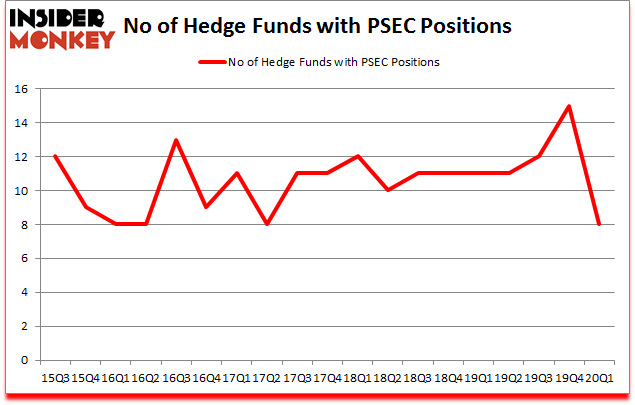

Prospect Capital Corporation (NASDAQ:PSEC) was in 8 hedge funds’ portfolios at the end of the first quarter of 2020. PSEC investors should be aware of a decrease in support from the world’s most elite money managers recently. There were 15 hedge funds in our database with PSEC positions at the end of the previous quarter. Our calculations also showed that PSEC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most traders, hedge funds are assumed to be worthless, old financial vehicles of the past. While there are greater than 8000 funds with their doors open at the moment, Our researchers choose to focus on the masters of this club, approximately 850 funds. These investment experts orchestrate the lion’s share of all hedge funds’ total asset base, and by keeping track of their top stock picks, Insider Monkey has found various investment strategies that have historically outpaced the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

David E. Shaw of D.E. Shaw

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s analyze the fresh hedge fund action regarding Prospect Capital Corporation (NASDAQ:PSEC).

What have hedge funds been doing with Prospect Capital Corporation (NASDAQ:PSEC)?

At the end of the first quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -47% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PSEC over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Prospect Capital Corporation (NASDAQ:PSEC) was held by Arrowstreet Capital, which reported holding $9.2 million worth of stock at the end of September. It was followed by Two Sigma Advisors with a $3.7 million position. Other investors bullish on the company included McKinley Capital Management, Engineers Gate Manager, and Citadel Investment Group. In terms of the portfolio weights assigned to each position McKinley Capital Management allocated the biggest weight to Prospect Capital Corporation (NASDAQ:PSEC), around 0.23% of its 13F portfolio. Corsair Capital Management is also relatively very bullish on the stock, setting aside 0.07 percent of its 13F equity portfolio to PSEC.

Seeing as Prospect Capital Corporation (NASDAQ:PSEC) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of fund managers who were dropping their entire stakes in the first quarter. Interestingly, Noam Gottesman’s GLG Partners dropped the biggest position of all the hedgies followed by Insider Monkey, totaling close to $12.4 million in stock, and Matt Sirovich and Jeremy Mindich’s Scopia Capital was right behind this move, as the fund sold off about $6.5 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 7 funds in the first quarter.

Let’s now review hedge fund activity in other stocks similar to Prospect Capital Corporation (NASDAQ:PSEC). These stocks are Epizyme Inc (NASDAQ:EPZM), Badger Meter, Inc. (NYSE:BMI), Hub Group Inc (NASDAQ:HUBG), and Arvinas, Inc. (NASDAQ:ARVN). All of these stocks’ market caps are similar to PSEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPZM | 22 | 351530 | 4 |

| BMI | 20 | 125239 | 0 |

| HUBG | 17 | 190642 | -2 |

| ARVN | 25 | 431346 | -1 |

| Average | 21 | 274689 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $275 million. That figure was $17 million in PSEC’s case. Arvinas, Inc. (NASDAQ:ARVN) is the most popular stock in this table. On the other hand Hub Group Inc (NASDAQ:HUBG) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Prospect Capital Corporation (NASDAQ:PSEC) is even less popular than HUBG. Hedge funds clearly dropped the ball on PSEC as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th and still beat the market by 14.8 percentage points. A small number of hedge funds were also right about betting on PSEC as the stock returned 29.8% so far in the second quarter and outperformed the market by an even larger margin.

Follow Prospect Capital Corp (NASDAQ:PSEC)

Follow Prospect Capital Corp (NASDAQ:PSEC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.