Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of Prologis Inc (NYSE:PLD) based on that data.

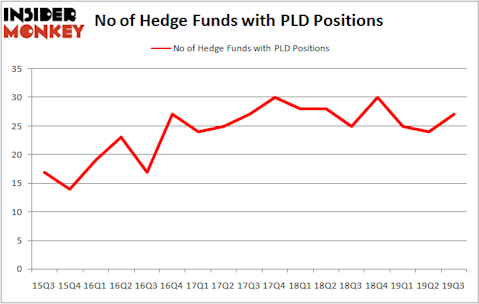

Is Prologis Inc (NYSE:PLD) a splendid stock to buy now? Prominent investors are getting more optimistic. The number of bullish hedge fund bets increased by 3 recently. Our calculations also showed that PLD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

If you’d ask most market participants, hedge funds are seen as underperforming, old investment tools of the past. While there are over 8000 funds with their doors open at present, Our experts hone in on the aristocrats of this group, around 750 funds. These investment experts oversee most of the hedge fund industry’s total asset base, and by tailing their top equity investments, Insider Monkey has found several investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to check out the recent hedge fund action surrounding Prologis Inc (NYSE:PLD).

Hedge fund activity in Prologis Inc (NYSE:PLD)

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the previous quarter. By comparison, 25 hedge funds held shares or bullish call options in PLD a year ago. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in Prologis Inc (NYSE:PLD) was held by AQR Capital Management, which reported holding $78.7 million worth of stock at the end of September. It was followed by Adage Capital Management with a $65.4 million position. Other investors bullish on the company included Citadel Investment Group, Winton Capital Management, and Millennium Management. In terms of the portfolio weights assigned to each position Bourgeon Capital allocated the biggest weight to Prologis Inc (NYSE:PLD), around 1.61% of its 13F portfolio. Winton Capital Management is also relatively very bullish on the stock, designating 0.57 percent of its 13F equity portfolio to PLD.

As aggregate interest increased, key money managers have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the most valuable position in Prologis Inc (NYSE:PLD). Balyasny Asset Management had $7.8 million invested in the company at the end of the quarter. David E. Shaw’s D E Shaw also made a $3.5 million investment in the stock during the quarter. The following funds were also among the new PLD investors: Paul Tudor Jones’s Tudor Investment Corp, Matthew Tewksbury’s Stevens Capital Management, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks similar to Prologis Inc (NYSE:PLD). These stocks are Vodafone Group Plc (NASDAQ:VOD), DuPont de Nemours, Inc. (NYSE:DD), Deere & Company (NYSE:DE), and Brookfield Asset Management Inc. (NYSE:BAM). All of these stocks’ market caps match PLD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VOD | 19 | 685397 | 8 |

| DD | 47 | 1502453 | 5 |

| DE | 40 | 1818266 | 0 |

| BAM | 31 | 1142775 | 9 |

| Average | 34.25 | 1287223 | 5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $1287 million. That figure was $361 million in PLD’s case. DuPont de Nemours, Inc. (NYSE:DD) is the most popular stock in this table. On the other hand Vodafone Group Plc (NASDAQ:VOD) is the least popular one with only 19 bullish hedge fund positions. Prologis Inc (NYSE:PLD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on PLD as the stock returned 55.9% in 2019 and outclassed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.