Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying for a while now that the current market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the third quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Prologis Inc (NYSE:PLD) changed recently.

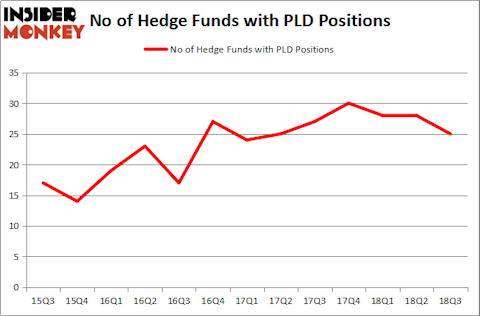

Prologis Inc (NYSE:PLD) has experienced a decrease in support from the world’s most elite money managers lately. PLD was in 25 hedge funds’ portfolios at the end of the third quarter of 2018. There were 28 hedge funds in our database with PLD positions at the end of the previous quarter. Our calculations also showed that PLD isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are viewed as slow, old investment tools of the past. While there are more than 8,000 funds with their doors open today, Our experts hone in on the bigwigs of this club, approximately 700 funds. Most estimates calculate that this group of people shepherd the majority of all hedge funds’ total asset base, and by following their top investments, Insider Monkey has discovered a number of investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to review the new hedge fund action regarding Prologis Inc (NYSE:PLD).

How are hedge funds trading Prologis Inc (NYSE:PLD)?

Heading into the fourth quarter of 2018, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the previous quarter. On the other hand, there were a total of 30 hedge funds with a bullish position in PLD at the beginning of this year. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in Prologis Inc (NYSE:PLD) was held by AEW Capital Management, which reported holding $152.8 million worth of stock at the end of September. It was followed by Millennium Management with a $109.9 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and Adage Capital Management.

Since Prologis Inc (NYSE:PLD) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there was a specific group of hedgies who sold off their positions entirely in the third quarter. At the top of the heap, John Khoury’s Long Pond Capital said goodbye to the biggest position of all the hedgies followed by Insider Monkey, totaling about $65 million in stock. Steve Cohen’s fund, Point72 Asset Management, also said goodbye to its stock, about $24.9 million worth. These moves are interesting, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Prologis Inc (NYSE:PLD) but similarly valued. We will take a look at The Sherwin-Williams Company (NYSE:SHW), Koninklijke Philips NV (NYSE:PHG), Prudential Financial Inc (NYSE:PRU), and Orange S.A. (NYSE:ORAN). This group of stocks’ market caps match PLD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHW | 38 | 1412679 | 3 |

| PHG | 15 | 456151 | 1 |

| PRU | 33 | 1057477 | 3 |

| ORAN | 1 | 3626 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $732 million. That figure was $666 million in PLD’s case. The Sherwin-Williams Company (NYSE:SHW) is the most popular stock in this table. On the other hand Orange SA (NYSE: ORAN) is the least popular one with only 1 bullish hedge fund positions. Prologis Inc (NYSE:PLD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SHW might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.