It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Nokia Corporation (NYSE:NOK).

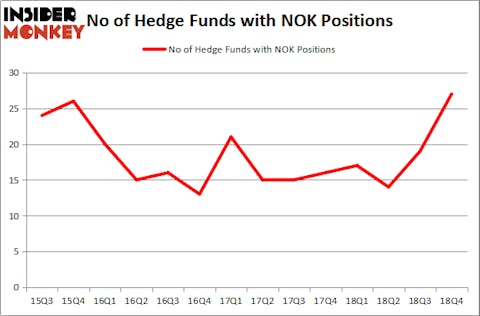

Is Nokia Corporation (NYSE:NOK) a worthy stock to buy now? Prominent investors are taking an optimistic view. The number of bullish hedge fund positions inched up by 8 recently. Our calculations also showed that NOK isn’t among the 30 most popular stocks among hedge funds. NOK was in 27 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 19 hedge funds in our database with NOK holdings at the end of the previous quarter.

In the eyes of most market participants, hedge funds are assumed to be underperforming, outdated investment tools of the past. While there are greater than 8000 funds in operation at the moment, Our experts hone in on the elite of this club, about 750 funds. It is estimated that this group of investors direct the majority of all hedge funds’ total asset base, and by keeping track of their highest performing stock picks, Insider Monkey has figured out a few investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a look at the new hedge fund action encompassing Nokia Corporation (NYSE:NOK).

How are hedge funds trading Nokia Corporation (NYSE:NOK)?

At Q4’s end, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 42% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in NOK a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Nokia Corporation (NYSE:NOK) was held by Ariel Investments, which reported holding $122.6 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $121.6 million position. Other investors bullish on the company included Levin Capital Strategies, Point72 Asset Management, and D E Shaw.

Consequently, specific money managers have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, initiated the biggest position in Nokia Corporation (NYSE:NOK). Point72 Asset Management had $71 million invested in the company at the end of the quarter. David Fiszel’s Honeycomb Asset Management also made a $11.6 million investment in the stock during the quarter. The other funds with brand new NOK positions are Bernard Selz’s Selz Capital, Lee Ainslie’s Maverick Capital, and Ernest Chow and Jonathan Howe’s Sensato Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Nokia Corporation (NYSE:NOK) but similarly valued. These stocks are Barclays PLC (NYSE:BCS), Edwards Lifesciences Corporation (NYSE:EW), ServiceNow Inc (NYSE:NOW), and LyondellBasell Industries NV (NYSE:LYB). All of these stocks’ market caps are closest to NOK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCS | 10 | 228838 | -1 |

| EW | 23 | 461037 | -6 |

| NOW | 61 | 2670389 | -4 |

| LYB | 37 | 1267887 | -2 |

| Average | 32.75 | 1157038 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $1157 million. That figure was $614 million in NOK’s case. ServiceNow Inc (NYSE:NOW) is the most popular stock in this table. On the other hand Barclays PLC (NYSE:BCS) is the least popular one with only 10 bullish hedge fund positions. Nokia Corporation (NYSE:NOK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately NOK wasn’t in this group. Hedge funds that bet on NOK were disappointed as the stock returned 9.8% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.