Jim Cramer, host of Mad Money, said on Monday that stocks tied to artificial intelligence and data-center spending, which had moved almost in lockstep for years, have suddenly begun drifting apart.

“For the past few years, virtually every stock connected to AI and the data center has been joined at the hip, and they’ve steadily marched higher together, but last month, that changed. Over the past two weeks, it’s become very obvious that Google’s Gemini 3 is now the best of the chatbots, surpassing OpenAI’s ChatGPT.”

READ ALSO: Jim Cramer’s Recent Responses to Questions About 12 Stocks and 16 Stocks Jim Cramer Recently Talked About.

Cramer said the change hit what he called the “OpenAI complex,” a group including NVIDIA, Oracle, AMD, Microsoft, CoreWeave, and SoftBank. He pointed out that the group used to trade similarly to what he referred to as the “Google complex,” but the two groups have now split. He mentioned that the OpenAI-linked names were all negative, falling an average of 23%, while Google-connected names fared better.

“At the same time, we’re starting to see another parallel contingent of haves and have-nots. This one’s the hyperscalers that have good balance sheets and hyperscalers that have not good balance sheets.”

Cramer noted that the hyperscalers have spent hundreds of billions of dollars on data-center buildouts. He mentioned Alphabet, Microsoft, Amazon, Meta, Oracle, along with private companies such as OpenAI and Elon Musk’s xAI as examples of companies that have poured enormous sums into the buildout cycle.

“So here’s the bottom line: Last month, the AI data center stocks finally started trading independently. The Google complex cohort roared while the OpenAI complex got hammered. Meanwhile, the hyperscalers with great balance sheets held up much better than the ones with strained balance sheets. Just keep in mind that things change very fast in the AI space, so what was true last month might not necessarily stay true this month or next year. That said, it’s hard to go wrong betting on the companies with superior balance sheets. As for ChatGPT versus Gemini versus everyone else, that can change in a heartbeat.”

Our Methodology

For this article, we compiled a list of 9 stocks that were discussed by Jim Cramer during the episode of Mad Money aired on December 1. We listed the stocks in the order that Cramer mentioned them. We also provided hedge fund sentiment for each stock as of the third quarter of 2025, which was taken from Insider Monkey’s database of 978 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 427.7% since May 2014, beating its benchmark by 264 percentage points (see more details here).

Jim Cramer Recently Discussed These 9 Stocks

9. Burlington Stores, Inc. (NYSE:BURL)

Number of Hedge Fund Holders: 44

Burlington Stores, Inc. (NYSE:BURL) is one of the stocks Jim Cramer recently discussed. Cramer mentioned the company while discussing the performance of retailers, as he commented:

“I can tell you that credit quality actually is surprisingly good, or I could go company by company, which is really my specialty. Right now, I find that other than Burlington Stores, every single retailer that’s reported is doing better than expected. In some cases, much better than Kohl’s. The resurgence of the department store, with Macy’s about to report excellent numbers on top of Kohl’s… The sizeable gains in share price for Best Buy was more than just noteworthy. The strength in the dollar stores is insane when you consider how badly they’ve been hit by tariffs. Same goes for Williams-Sonoma, Wayfair, and most notably Gap, which shot the lights out.”

Burlington Stores, Inc. (NYSE:BURL) provides merchandise across apparel, footwear, accessories, home goods, toys, gifts, and baby and beauty products.

8. Waters Corporation (NYSE:WAT)

Number of Hedge Fund Holders: 42

Waters Corporation (NYSE:WAT) is one of the stocks Jim Cramer recently discussed. Cramer discussed the company’s upcoming merger with Becton, Dickinson’s biosciences and diagnostics business. He remarked:

“Finally, please don’t forget about one that was always my personal favorite, never owned it for the trust, Waters Corporation, one of the quieter companies in this space that specializes in liquid chromatography and mass spectrometry. Now, that’s stuff that you need to be able to do all this life science things. For much of the past few years, Waters was holding up much better than the rest of the industry. But the stock got hit real hard earlier this year, in part because the company announced a complex deal to merge with Becton, Dickinson’s biosciences and diagnostics business back in July.

The market didn’t like the deal initially, and Waters saw its stock plunge. It was so hard to understand. Things then turned around, though. Now, the stock’s up about 45% from its August lows. Now, some of that’s because Waters arguably reported the best quarter in the group about a month ago, revenue up 8% on a constant currency basis, along with a healthy earnings beat. Management also gave a nice boost to their full-year forecast. Now, Waters is still tricky because of that Becton, Dickinson biosciences deal. It’s expected to close in the first quarter of next year, but once that happens, I think it’s going to be a much, much bigger player and really I think it should be loved on Wall Street.”

Waters Corporation (NYSE:WAT) provides liquid chromatography, mass spectrometry, thermal analysis, rheometry, and calorimetry systems. The company’s technologies are used for research, product development, quality checks, and specialized testing.

7. Revvity, Inc. (NYSE:RVTY)

Number of Hedge Fund Holders: 22

Revvity, Inc. (NYSE:RVTY) is one of the stocks Jim Cramer recently discussed. Cramer highlighted the company’s cheap valuation compared to its group, as he said:

“Now, I’ve got two more smaller life science arms dealers to round out things. First one’s called Revvity. You might’ve seen that one trade. That’s the life science business that remained when PerkinElmer broke itself up about two and a half years ago. PerkinElmer sold its applied food and enterprise services business to a private equity firm, and that business took the PerkinElmer name with it. The remaining life sciences business, which remained publicly traded, was renamed Revvity.

Now, after a couple years of disappointing results where the stock went nowhere, Revvity finally posted some better-than-expected numbers in October, and management raised their full-year earnings forecast. It was a good solid result from a company that hasn’t really given us much in those recent years, and the stock’s gotten some traction since then. Revvity’s the cheapest in the group with the stock selling for around 21 times this year’s earnings estimates.”

Revvity, Inc. (NYSE:RVTY) provides instruments, reagents, software, and sequencing services used for genetic testing, disease screening, and diagnostic and research applications.

6. Thermo Fisher Scientific Inc. (NYSE:TMO)

Number of Hedge Fund Holders: 121

Thermo Fisher Scientific Inc. (NYSE:TMO) is one of the stocks Jim Cramer recently discussed. Cramer highlighted the company’s decline and comeback during the year, as he stated:

“Next, there’s the biggest player in the group, and that’s Thermo Fisher Scientific, which does a bit of everything, selling big ticket equipment, consumables, and services to companies all across the life sciences industry with a new focus on clinical research services followed by the, that’s because of an acquisition they made called PPD a few years ago. Thermo Fisher experienced one of the biggest declines in the group earlier this year, but its stock [has] had a strong recovery since then.

It is currently up more than 50% from its mid-June lows. You know, I feel particularly good about this Thermo Fisher because, well, I got to speak with the CEO, Marc Casper, in late October. He told an excellent story. This was right after the company reported a good quarter, a healthy top and bottom line beat, with management raising their full-year forecast. Casper told us about strength across his businesses. Not only are his commercial end markets doing great, but even previously tough areas like academia, which really shocked me, given the way the government’s been, government itself, and China, which has been terrible, were solid and growing again.

Casper also called out the reshoring theme that Agilent mentioned last time. At the same time, Thermo Fisher’s also partnering with OpenAI to create new tools and technologies that the company hopes will help speed up the drug development process, a real-world use for AI that costs, well, it goes beyond cost savings. Plus, some of the acquisitions Thermo Fisher’s made recently, they’re starting to pay off. The company actually announced another deal a few days after that interview.

They’re paying nearly $9 billion to buy a company called Clario Holdings, which will give them even more exposure to the clinical trial ecosystem. Putting it all together, Thermo Fisher feels like it’s back to being the company that I love for so many years, I’m talking about since the show began. They’re talking less about some inventory glut somewhere and more about the exciting technologies they’re creating. It is such a pleasure to listen to that company now.”

Thermo Fisher Scientific Inc. (NYSE:TMO) offers instruments, reagents, consumables, software, and lab services that support scientific research, diagnostics, and drug and vaccine development.

5. Danaher Corporation (NYSE:DHR)

Number of Hedge Fund Holders: 117

Danaher Corporation (NYSE:DHR) is one of the stocks Jim Cramer recently discussed. Cramer noted that he still likes the stock for the Charitable Trust, as he said:

“Now, first, there’s tried and true, but lately trying Danaher, DHR, a conglomerate that became more focused on life sciences diagnostics when it spun off its water and product quality testing business as Veralto a couple years ago. We own Danaher for the Charitable Trust. I gotta tell you, it’s been really frustrating for the past couple years, even though we bought it during the post-COVID washout. Turns out that was early, as the stock languished for a very long time. Lately, though, Danaher’s been acting much better. It’s up 31% from its April low. It’s up 25% from its more recent low… in September. Now get this, in late October, in the middle of the stock’s most recent rally, Danaher reported a strong quarter driven by solid growth numbers from the company’s crucial bioprocessing division, which had been so languishing. They posted a small revenue beat with a solid 3% organic growth, as well as a large earnings beat. While management merely reiterated their full-year sales and earnings forecast, that was enough to get the stock, I told you it’s been… in just a hell hole, get the stock moving higher. Looking ahead, Wall Street expects Danaher to put up its best growth in years in 2026, mid-single-digit revenue growth, and high single-digit earnings growth. If they can hit those targets, I bet the stock keeps running. I still like the stock for the Charitable Trust, but we bought some stock real low in this one, and I’m thinking of trimming it if the stock jumps another 10 points, but 10 could be a lot.”

Danaher Corporation (NYSE:DHR) provides instruments, consumables, software, and services used in bioprocessing, life sciences research, and clinical diagnostics.

4. Agilent Technologies, Inc. (NYSE:A)

Number of Hedge Fund Holders: 53

Agilent Technologies, Inc. (NYSE:A) is one of the stocks Jim Cramer recently discussed. Cramer discussed the company’s performance over the longer term, as he commented:

“Last week, just before Thanksgiving, I got the chance to speak with Agilent Technologies. That’s an arms dealer to the life sciences industry. A long time ago, this stock, known as letter A for its stock symbol, was a great growth vehicle. In the decade before COVID, Agilent’s chart was just a thing of beauty. Then, when the pandemic got rolling, the stock roared even higher, and ever since the pandemic receded, things got choppy for this one but also for the entire industry. The life sciences companies had all the equipment they needed, so the whole group spent years in the dog house.

Lately, though, the thing’s just caught fire. Agilent’s now up more than 55% from its April lows. And that interview with CEO Padraig McDonnell on our show was very encouraging. The company had just reported a very solid quarter last Monday night with a 7% organic growth, and he made me feel like the business is really turning around. Now, some of that’s company-specific, but some of it’s industry-wide. McDonnell explained that they’re seeing a big push for reshoring in life sciences manufacturing… federal initiative, along with the rise of novel types of medicine that require more hardware to produce. At the same time, the Trump FDA turns out to be a lot less disruptive than many on Wall Street expected, even with RFK Jr. at the helm at Health and Human Services.”

Agilent Technologies, Inc. (NYSE:A) provides instruments, software, and services for life sciences, diagnostics, and chemical analysis, including chromatography, spectroscopy, genomics, and laboratory automation solutions.

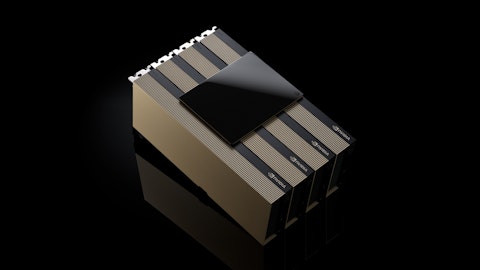

3. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 234

NVIDIA Corporation (NASDAQ:NVDA) is one of the stocks Jim Cramer recently discussed. Cramer showed his optimistic stance on the company during the episode. The Mad Money host remarked:

“Finally, let’s be careful not to paint with too broad a brush here. For example, NVIDIA got clobbered… last month on worries about newfound competition. Remember, it’s also part of the so-called OpenAI complex. But let’s not forget that NVIDIA just reported a blowout set of numbers less than two weeks ago with excellent guidance for the current quarter. And broader market dynamics notwithstanding, NVIDIA is still essentially sold out for its latest generation of chips. Demand for these things will far exceed supply. And don’t forget what happened today when they announced the deal with Synopsys. Until everything changes or until the company stops being the average, the industry standard bearer for AI developers, you know, I got a real hard time getting too negative on Jensen Huang’s company. You know that. Once again, I say own NVIDIA, don’t trade it. That is my takeaway.”

NVIDIA Corporation (NASDAQ:NVDA) develops accelerated computing and AI platforms, GPUs for gaming and professional use, cloud services, robotics and embedded systems, and automotive technologies.

2. Alphabet Inc. (NASDAQ:GOOGL)

Number of Hedge Fund Holders: 243

Alphabet Inc. (NASDAQ:GOOGL) is one of the stocks Jim Cramer recently discussed. Cramer highlighted the company’s Gemini 3 improvement, as he commented:

“The Gemini 3 improvement was very good news for Google and all the stocks connected to the AI efforts… So Google stock soared, as did Broadcom, which helped make the custom processors that were used to train Gemini 3. Hey, same goes [for] Celestica, remember that one, CLS, the contract manufacturer, and a couple of similar networking equipment vendors we don’t talk much about, Lumentum, TTM Technologies… The five stocks in the Google complex were all flat or positive in November, up nearly 18% on average… I need to warn you about chasing these ideas. If you want to buy the Google complex names I just mentioned, you’re probably a bit late. The gains from Gemini 3 already seem to be baked in. Quite a move. More importantly, last month showed us how quickly things can change in the AI space.”

Alphabet Inc. (NASDAQ:GOOGL) provides tech-related products and services, including search, advertising, cloud computing, AI tools, and digital content platforms like YouTube and Google Play.

1. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 166

Apple Inc. (NASDAQ:AAPL) is one of the stocks Jim Cramer recently discussed. Cramer discussed the company’s AI strategy, as he stated:

“Speaking of balance sheets, now that Wall Street’s getting worried about all the data center spending, Apple’s starting to look real smart for sitting on its hands the whole time. They were criticized for that. I don’t know about that anymore. Like I’ve been saying, why should they shell out billions to build out all this infrastructure when any of the generative AI companies would happily pay them tens of billions to be the default chatbot for Apple’s ecosystem? Apple’s up over 3% in November, it’s up over 13% year to date, big multiple expansion. Now, if I were managing one of these chatbots… and I was up against Gemini 3, I would be running to Apple with my checkbook in hand, hoping they would let me pay them to be the default AI site. But I think only Gemini 3 right now would rank as acceptable to Cupertino.”

Apple Inc. (NASDAQ:AAPL) manufactures and sells devices such as the iPhone, Mac, iPad, along with its line-up of wearables and accessories. The devices are supported by the company’s app ecosystem, AppleCare, and cloud tools.

While we acknowledge the potential of Apple Inc. (NASDAQ:AAPL) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than AAPL and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.