“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Is Vipshop Holdings Limited (NYSE:VIPS) going to take off soon? Prominent investors are in a pessimistic mood. The number of bullish hedge fund positions were trimmed by 5 lately. Our calculations also showed that vips isn’t among the 30 most popular stocks among hedge funds. VIPS was in 22 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with VIPS positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a glance at the fresh hedge fund action regarding Vipshop Holdings Limited (NYSE:VIPS).

What have hedge funds been doing with Vipshop Holdings Limited (NYSE:VIPS)?

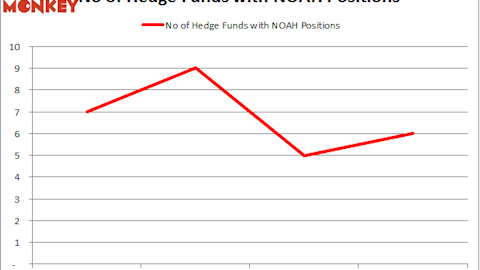

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards VIPS over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Fang Zheng’s Keywise Capital Management has the largest position in Vipshop Holdings Limited (NYSE:VIPS), worth close to $37.2 million, corresponding to 13.3% of its total 13F portfolio. On Keywise Capital Management’s heels is AQR Capital Management, led by Cliff Asness, holding a $13.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish consist of Mason Hawkins’s Southeastern Asset Management, Jim Simons’s Renaissance Technologies and Nitin Saigal and Dan Jacobs’s Kora Management.

Seeing as Vipshop Holdings Limited (NYSE:VIPS) has witnessed bearish sentiment from the smart money, logic holds that there is a sect of funds that elected to cut their entire stakes in the third quarter. It’s worth mentioning that Adam Wolfberg and Steven Landry’s EastBay Asset Management dumped the largest stake of the 700 funds followed by Insider Monkey, totaling an estimated $35.5 million in stock, and Beeneet Kothari’s Tekne Capital Management was right behind this move, as the fund said goodbye to about $16.5 million worth. These transactions are important to note, as total hedge fund interest fell by 5 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vipshop Holdings Limited (NYSE:VIPS) but similarly valued. These stocks are Evercore Inc. (NYSE:EVR), F.N.B. Corp (NYSE:FNB), Sabra Health Care REIT Inc (NASDAQ:SBRA), and Yelp Inc (NYSE:YELP). This group of stocks’ market valuations are closest to VIPS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVR | 22 | 273405 | 0 |

| FNB | 12 | 52228 | 0 |

| SBRA | 9 | 58109 | -3 |

| YELP | 30 | 1018373 | 4 |

| Average | 18.25 | 350529 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $351 million. That figure was $130 million in VIPS’s case. Yelp Inc (NYSE:YELP) is the most popular stock in this table. On the other hand Sabra Health Care REIT Inc (NASDAQ:SBRA) is the least popular one with only 9 bullish hedge fund positions. Vipshop Holdings Limited (NYSE:VIPS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard YELP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.