“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Varex Imaging Corporation (NASDAQ:VREX) and see how it was affected.

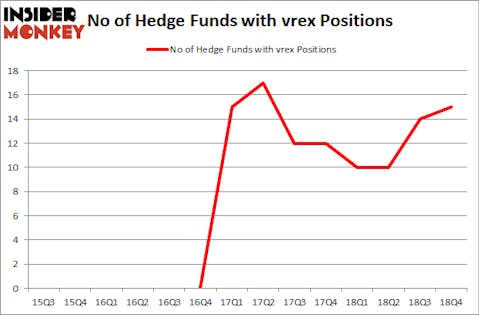

Is Varex Imaging Corporation (NASDAQ:VREX) a buy right now? Money managers are getting more bullish. The number of long hedge fund positions went up by 1 recently. Our calculations also showed that vrex isn’t among the 30 most popular stocks among hedge funds. VREX was in 15 hedge funds’ portfolios at the end of December. There were 14 hedge funds in our database with VREX holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the fresh hedge fund action regarding Varex Imaging Corporation (NASDAQ:VREX).

How are hedge funds trading Varex Imaging Corporation (NASDAQ:VREX)?

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VREX over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Pzena Investment Management held the most valuable stake in Varex Imaging Corporation (NASDAQ:VREX), which was worth $32.2 million at the end of the fourth quarter. On the second spot was Rutabaga Capital Management which amassed $12.1 million worth of shares. Moreover, D E Shaw, Royce & Associates, and Winton Capital Management were also bullish on Varex Imaging Corporation (NASDAQ:VREX), allocating a large percentage of their portfolios to this stock.

Now, some big names were breaking ground themselves. Pzena Investment Management, managed by Richard S. Pzena, created the most valuable position in Varex Imaging Corporation (NASDAQ:VREX). Pzena Investment Management had $32.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $5.6 million position during the quarter. The other funds with new positions in the stock are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, John Overdeck and David Siegel’s Two Sigma Advisors, and Hoon Kim’s Quantinno Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Varex Imaging Corporation (NASDAQ:VREX) but similarly valued. We will take a look at Emerald Expositions Events, Inc. (NYSE:EEX), Codexis, Inc. (NASDAQ:CDXS), Trueblue Inc (NYSE:TBI), and Lattice Semiconductor Corporation (NASDAQ:LSCC). This group of stocks’ market values match VREX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EEX | 11 | 8913 | 1 |

| CDXS | 13 | 276255 | 1 |

| TBI | 15 | 61257 | 1 |

| LSCC | 22 | 139452 | 4 |

| Average | 15.25 | 121469 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $121 million. That figure was $86 million in VREX’s case. Lattice Semiconductor Corporation (NASDAQ:LSCC) is the most popular stock in this table. On the other hand Emerald Expositions Events, Inc. (NYSE:EEX) is the least popular one with only 11 bullish hedge fund positions. Varex Imaging Corporation (NASDAQ:VREX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on VREX as the stock returned 34% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.