Is Tristate Capital Holdings Inc (NASDAQ:TSC) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

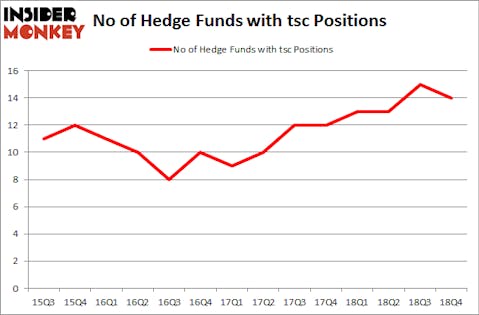

Tristate Capital Holdings Inc (NASDAQ:TSC) investors should be aware of a decrease in enthusiasm from smart money in recent months. TSC was in 14 hedge funds’ portfolios at the end of December. There were 15 hedge funds in our database with TSC holdings at the end of the previous quarter. Our calculations also showed that tsc isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are assumed to be underperforming, old investment vehicles of years past. While there are more than 8000 funds with their doors open at present, Our experts look at the top tier of this group, about 750 funds. Most estimates calculate that this group of people watch over the majority of all hedge funds’ total capital, and by keeping track of their finest equity investments, Insider Monkey has revealed a few investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s view the latest hedge fund action encompassing Tristate Capital Holdings Inc (NASDAQ:TSC).

What have hedge funds been doing with Tristate Capital Holdings Inc (NASDAQ:TSC)?

At Q4’s end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TSC over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Second Curve Capital, managed by Tom Brown, holds the most valuable position in Tristate Capital Holdings Inc (NASDAQ:TSC). Second Curve Capital has a $16.6 million position in the stock, comprising 16.5% of its 13F portfolio. Sitting at the No. 2 spot is Royce & Associates, managed by Chuck Royce, which holds a $16.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers that are bullish contain Jim Simons’s Renaissance Technologies, Richard Driehaus’s Driehaus Capital and Ken Griffin’s Citadel Investment Group.

Seeing as Tristate Capital Holdings Inc (NASDAQ:TSC) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few money managers who were dropping their entire stakes heading into Q3. Interestingly, Richard S. Meisenberg’s ACK Asset Management dropped the largest stake of the 700 funds watched by Insider Monkey, comprising about $8.3 million in stock, and Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management was right behind this move, as the fund said goodbye to about $7.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Tristate Capital Holdings Inc (NASDAQ:TSC) but similarly valued. We will take a look at Camden National Corporation (NASDAQ:CAC), Weatherford International plc (NYSE:WFT), Global Brass and Copper Holdings Inc (NYSE:BRSS), and Equity Bancshares, Inc. (NASDAQ:EQBK). All of these stocks’ market caps resemble TSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAC | 6 | 50846 | 0 |

| WFT | 22 | 78735 | 1 |

| BRSS | 15 | 53276 | -2 |

| EQBK | 7 | 55617 | 0 |

| Average | 12.5 | 59619 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $59 million in TSC’s case. Weatherford International plc (NYSE:WFT) is the most popular stock in this table. On the other hand Camden National Corporation (NASDAQ:CAC) is the least popular one with only 6 bullish hedge fund positions. Tristate Capital Holdings Inc (NASDAQ:TSC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on TSC, though not to the same extent, as the stock returned 16.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.