A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of SkyWest, Inc. (NASDAQ:SKYW) during the quarter.

Hedge fund interest in SkyWest, Inc. (NASDAQ:SKYW) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Senior Housing Properties Trust (NASDAQ:SNH), Ormat Technologies, Inc. (NYSE:ORA), and Aerojet Rocketdyne Holdings Inc (NYSE:AJRD) to gather more data points.

To the average investor there are a lot of methods shareholders use to size up stocks. A couple of the most useful methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass the market by a superb margin (see the details here).

Paul Reeder of PAR Capital

We’re going to check out the new hedge fund action encompassing SkyWest, Inc. (NASDAQ:SKYW).

Hedge fund activity in SkyWest, Inc. (NASDAQ:SKYW)

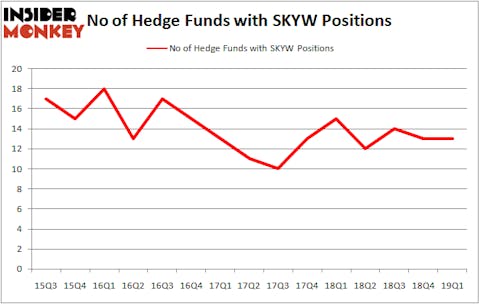

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in SKYW over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in SkyWest, Inc. (NASDAQ:SKYW). Renaissance Technologies has a $116.6 million position in the stock, comprising 0.1% of its 13F portfolio. On Renaissance Technologies’s heels is Paul Reeder and Edward Shapiro of PAR Capital Management, with a $24.9 million position; 0.5% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that hold long positions include Paul Marshall and Ian Wace’s Marshall Wace LLP, Cliff Asness’s AQR Capital Management and Israel Englander’s Millennium Management.

Seeing as SkyWest, Inc. (NASDAQ:SKYW) has witnessed falling interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of funds that slashed their entire stakes heading into Q3. It’s worth mentioning that Ken Griffin’s Citadel Investment Group sold off the largest investment of all the hedgies monitored by Insider Monkey, totaling an estimated $2.6 million in stock. Ira Unschuld’s fund, Brant Point Investment Management, also cut its stock, about $2 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to SkyWest, Inc. (NASDAQ:SKYW). We will take a look at Senior Housing Properties Trust (NASDAQ:SNH), Ormat Technologies, Inc. (NYSE:ORA), Aerojet Rocketdyne Holdings Inc (NYSE:AJRD), and Cantel Medical Corp. (NYSE:CMD). All of these stocks’ market caps are similar to SKYW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNH | 17 | 69196 | -4 |

| ORA | 9 | 153748 | 4 |

| AJRD | 15 | 386942 | -4 |

| CMD | 18 | 143681 | 5 |

| Average | 14.75 | 188392 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $188 million. That figure was $166 million in SKYW’s case. Cantel Medical Corp. (NYSE:CMD) is the most popular stock in this table. On the other hand Ormat Technologies, Inc. (NYSE:ORA) is the least popular one with only 9 bullish hedge fund positions. SkyWest, Inc. (NASDAQ:SKYW) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on SKYW as the stock returned 9.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.