Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

Six Flags Entertainment Corp (NYSE:SIX) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 30 hedge funds’ portfolios at the end of the second quarter of 2019. At the end of this article we will also compare SIX to other stocks including The Boston Beer Company Inc (NYSE:SAM), New Jersey Resources Corp (NYSE:NJR), and Generac Holdings Inc. (NYSE:GNRC) to get a better sense of its popularity. Our calculations also showed that SIX isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are many indicators shareholders can use to appraise stocks. Some of the most underrated indicators are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outperform the S&P 500 by a superb margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the key hedge fund action surrounding Six Flags Entertainment Corp (NYSE:SIX).

What does smart money think about Six Flags Entertainment Corp (NYSE:SIX)?

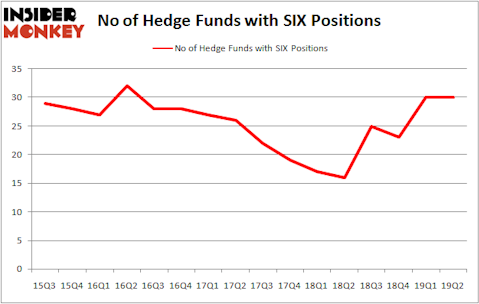

At the end of the second quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards SIX over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Rehan Jaffer’s H Partners Management has the biggest position in Six Flags Entertainment Corp (NYSE:SIX), worth close to $244.1 million, corresponding to 29.4% of its total 13F portfolio. Coming in second is Millennium Management, led by Israel Englander, holding a $95.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism comprise D. E. Shaw’s D E Shaw, Amy Minella’s Cardinal Capital and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Six Flags Entertainment Corp (NYSE:SIX) has faced bearish sentiment from the entirety of the hedge funds we track, we can see that there were a few hedge funds who were dropping their entire stakes in the second quarter. At the top of the heap, Renaissance Technologies sold off the largest investment of all the hedgies watched by Insider Monkey, valued at close to $19.8 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also sold off its stock, about $13.4 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Six Flags Entertainment Corp (NYSE:SIX). We will take a look at The Boston Beer Company Inc (NYSE:SAM), New Jersey Resources Corp (NYSE:NJR), Generac Holdings Inc. (NYSE:GNRC), and Pinnacle Financial Partners, Inc. (NASDAQ:PNFP). This group of stocks’ market values match SIX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAM | 23 | 591137 | 1 |

| NJR | 12 | 78095 | 1 |

| GNRC | 25 | 229086 | 8 |

| PNFP | 18 | 78507 | 3 |

| Average | 19.5 | 244206 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $244 million. That figure was $742 million in SIX’s case. Generac Holdings Inc. (NYSE:GNRC) is the most popular stock in this table. On the other hand New Jersey Resources Corp (NYSE:NJR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Six Flags Entertainment Corp (NYSE:SIX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SIX, though not to the same extent, as the stock returned 3.7% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.