Like everyone else, successful investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show successful investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what successful funds and billionaire investors think before doing extensive research on a stock. In this article, we take a closer look at Sasol Limited (ADR) (NYSE:SSL) from the perspective of those successful funds.

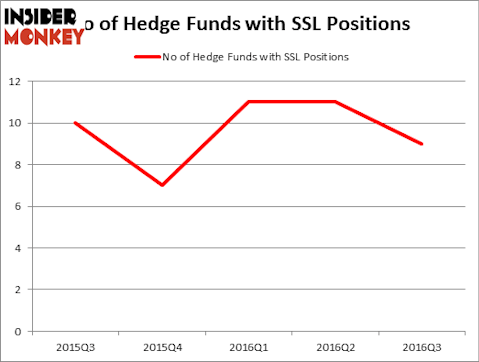

Is Sasol Limited (ADR) (NYSE:SSL) an exceptional investment today? Hedge funds seem to be taking a bearish view. The number of bullish hedge fund positions reported by funds from our database dropped by two during the third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Molson Coors Brewing Company (NYSE:TAP), POSCO (ADR) (NYSE:PKX), and HCP, Inc. (NYSE:HCP) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

huyangshu/Shutterstock.com

Keeping this in mind, let’s take a glance at the key action encompassing Sasol Limited (ADR) (NYSE:SSL).

What does the smart money think about Sasol Limited (ADR) (NYSE:SSL)?

Heading into the fourth quarter of 2016, nine of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 18% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SSL over the last five quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies which is one of the largest hedge funds in the world, has the number one position in Sasol Limited (ADR) (NYSE:SSL), worth close to $14.6 million. Coming in second is William B. Gray’s Orbis Investment Management holding a $6.1 million position. Other hedge funds and institutional investors that are bullish include Israel Englander’s Millennium Management, David Costen Haley’s HBK Investments, and Cliff Asness’ AQR Capital Management. We should note that Orbis Investment Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually cashed in their positions entirely. Intriguingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cashed in the largest position of all the investors watched by Insider Monkey, comprising an estimated $34.1 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also said goodbye to its stock, about $0.8 million worth.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Sasol Limited (ADR) (NYSE:SSL) but similarly valued. These stocks are Molson Coors Brewing Company (NYSE:TAP), POSCO (ADR) (NYSE:PKX), HCP, Inc. (NYSE:HCP), and Incyte Corporation (NASDAQ:INCY). This group of stocks’ market values are similar to SSL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TAP | 59 | 3398701 | 2 |

| PKX | 14 | 100738 | -1 |

| HCP | 14 | 154380 | -2 |

| INCY | 45 | 3250309 | 13 |

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $1726 million. That figure was just $23 million in SSL’s case. Molson Coors Brewing Company (NYSE:TAP) is the most popular stock in this table. On the other hand POSCO (ADR) (NYSE:PKX) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Sasol Limited (ADR) (NYSE:SSL) is even less popular than PKX. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Best Food Countries In Europe

Best Cosmetic Companies In The World

Biggest Malls In The World

Disclosure: None