Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Sandy Spring Bancorp Inc. (NASDAQ:SASR).

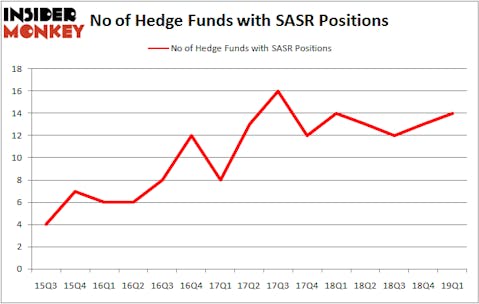

Sandy Spring Bancorp Inc. (NASDAQ:SASR) investors should pay attention to an increase in support from the world’s most elite money managers in recent months. SASR was in 14 hedge funds’ portfolios at the end of March. There were 13 hedge funds in our database with SASR holdings at the end of the previous quarter. Our calculations also showed that SASR isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of tools stock market investors put to use to appraise publicly traded companies. A pair of the most underrated tools are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the best fund managers can outperform the market by a significant amount (see the details here).

We’re going to check out the key hedge fund action surrounding Sandy Spring Bancorp Inc. (NASDAQ:SASR).

What have hedge funds been doing with Sandy Spring Bancorp Inc. (NASDAQ:SASR)?

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from one quarter earlier. On the other hand, there were a total of 14 hedge funds with a bullish position in SASR a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Sandy Spring Bancorp Inc. (NASDAQ:SASR), which was worth $33.5 million at the end of the first quarter. On the second spot was Forest Hill Capital which amassed $12.2 million worth of shares. Moreover, Millennium Management, Basswood Capital, and EJF Capital were also bullish on Sandy Spring Bancorp Inc. (NASDAQ:SASR), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, specific money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the largest position in Sandy Spring Bancorp Inc. (NASDAQ:SASR). Arrowstreet Capital had $1 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.3 million position during the quarter. The only other fund with a brand new SASR position is Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Sandy Spring Bancorp Inc. (NASDAQ:SASR) but similarly valued. These stocks are Loral Space & Communications Inc. (NASDAQ:LORL), Herc Holdings Inc. (NYSE:HRI), Codexis, Inc. (NASDAQ:CDXS), and Heritage Financial Corporation (NASDAQ:HFWA). All of these stocks’ market caps are closest to SASR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LORL | 19 | 544117 | 1 |

| HRI | 28 | 485007 | 1 |

| CDXS | 11 | 294486 | -2 |

| HFWA | 7 | 54687 | -1 |

| Average | 16.25 | 344574 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $345 million. That figure was $81 million in SASR’s case. Herc Holdings Inc. (NYSE:HRI) is the most popular stock in this table. On the other hand Heritage Financial Corporation (NASDAQ:HFWA) is the least popular one with only 7 bullish hedge fund positions. Sandy Spring Bancorp Inc. (NASDAQ:SASR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on SASR as the stock returned 8.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.