Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees during the first half of 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the second quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Rogers Communications Inc. (NYSE:RCI).

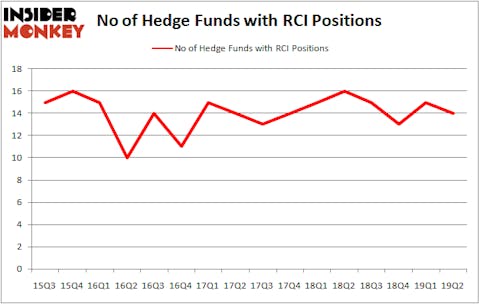

Rogers Communications Inc. (NYSE:RCI) has seen a decrease in support from the world’s most elite money managers of late. Our calculations also showed that RCI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the new hedge fund action regarding Rogers Communications Inc. (NYSE:RCI).

What does smart money think about Rogers Communications Inc. (NYSE:RCI)?

At the end of the second quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RCI over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, holds the number one position in Rogers Communications Inc. (NYSE:RCI). Renaissance Technologies has a $179.4 million position in the stock, comprising 0.2% of its 13F portfolio. On Renaissance Technologies’s heels is GLG Partners, led by Noam Gottesman, holding a $52.6 million position; 0.2% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, John Overdeck and David Siegel’s Two Sigma Advisors and Mario Gabelli’s GAMCO Investors.

Since Rogers Communications Inc. (NYSE:RCI) has experienced falling interest from the aggregate hedge fund industry, we can see that there were a few hedge funds who were dropping their full holdings last quarter. At the top of the heap, Benjamin A. Smith’s Laurion Capital Management dumped the largest investment of all the hedgies monitored by Insider Monkey, valued at close to $18.5 million in stock, and Minhua Zhang’s Weld Capital Management was right behind this move, as the fund said goodbye to about $0.8 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Rogers Communications Inc. (NYSE:RCI) but similarly valued. We will take a look at Discovery, Inc. (NASDAQ:DISCK), Telefonica Brasil SA (NYSE:VIV), KKR & Co Inc. (NYSE:KKR), and Corteva, Inc. (NYSE:CTVA). This group of stocks’ market valuations are closest to RCI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DISCK | 30 | 906989 | 4 |

| VIV | 12 | 56144 | 3 |

| KKR | 36 | 2910243 | 6 |

| CTVA | 36 | 615610 | 36 |

| Average | 28.5 | 1122247 | 12.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $1122 million. That figure was $364 million in RCI’s case. KKR & Co Inc. (NYSE:KKR) is the most popular stock in this table. On the other hand Telefonica Brasil SA (NYSE:VIV) is the least popular one with only 12 bullish hedge fund positions. Rogers Communications Inc. (NYSE:RCI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately RCI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); RCI investors were disappointed as the stock returned -8.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.