We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Roan Resources, Inc. (NYSE:ROAN).

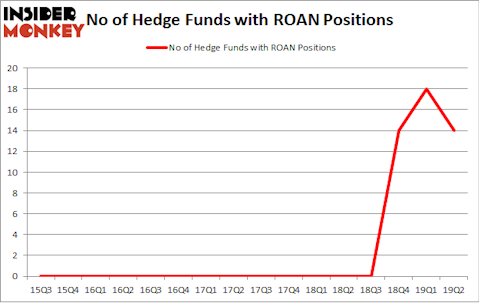

Roan Resources, Inc. (NYSE:ROAN) shareholders have witnessed a decrease in enthusiasm from smart money recently. Our calculations also showed that ROAN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Singer of Elliott Management

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s take a glance at the key hedge fund action surrounding Roan Resources, Inc. (NYSE:ROAN).

What does smart money think about Roan Resources, Inc. (NYSE:ROAN)?

At Q2’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in ROAN a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Roan Resources, Inc. (NYSE:ROAN) was held by Elliott Management, which reported holding $28.4 million worth of stock at the end of March. It was followed by Fir Tree with a $25.6 million position. Other investors bullish on the company included York Capital Management, Avenue Capital, and Canyon Capital Advisors.

Due to the fact that Roan Resources, Inc. (NYSE:ROAN) has faced a decline in interest from the smart money, we can see that there were a few funds that slashed their positions entirely by the end of the second quarter. Interestingly, Dan Kamensky’s Marble Ridge Capital dropped the biggest stake of the 750 funds followed by Insider Monkey, valued at about $22.8 million in stock. James Thomas Berylson’s fund, Berylson Capital Partners, also dropped its stock, about $1.7 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 4 funds by the end of the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Roan Resources, Inc. (NYSE:ROAN) but similarly valued. These stocks are Arlington Asset Investment Corp (NYSE:AI), General Finance Corporation (NASDAQ:GFN), Safeguard Scientifics, Inc (NYSE:SFE), and Athersys, Inc. (NASDAQ:ATHX). This group of stocks’ market values are similar to ROAN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AI | 7 | 13961 | 1 |

| GFN | 5 | 7777 | -2 |

| SFE | 6 | 30575 | 1 |

| ATHX | 5 | 2007 | -1 |

| Average | 5.75 | 13580 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $14 million. That figure was $86 million in ROAN’s case. Arlington Asset Investment Corp (NYSE:AI) is the most popular stock in this table. On the other hand General Finance Corporation (NASDAQ:GFN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Roan Resources, Inc. (NYSE:ROAN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ROAN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ROAN were disappointed as the stock returned -29.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.