The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider RH (NYSE:RH) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

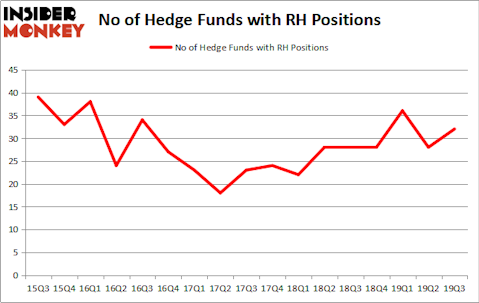

RH (NYSE:RH) was in 32 hedge funds’ portfolios at the end of the third quarter of 2019. RH has experienced an increase in hedge fund sentiment lately. There were 28 hedge funds in our database with RH holdings at the end of the previous quarter. Our calculations also showed that RH isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of formulas shareholders use to assess their stock investments. Some of the less utilized formulas are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can trounce their index-focused peers by a significant amount (see the details here).

Bill Miller of Miller Value Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the fresh hedge fund action regarding RH (NYSE:RH).

How have hedgies been trading RH (NYSE:RH)?

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. On the other hand, there were a total of 28 hedge funds with a bullish position in RH a year ago. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in RH (NYSE:RH) was held by Berkshire Hathaway, which reported holding $206.3 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $197 million position. Other investors bullish on the company included Miller Value Partners, Nantahala Capital Management, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position Miller Value Partners allocated the biggest weight to RH (NYSE:RH), around 4.67% of its portfolio. Wallace Capital Management is also relatively very bullish on the stock, earmarking 4.03 percent of its 13F equity portfolio to RH.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Berkshire Hathaway, managed by Warren Buffett, created the most outsized position in RH (NYSE:RH). Berkshire Hathaway had $206.3 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $20.1 million position during the quarter. The following funds were also among the new RH investors: Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital, Lee Ainslie’s Maverick Capital, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as RH (NYSE:RH) but similarly valued. We will take a look at Brookfield Business Partners L.P. (NYSE:BBU), Community Bank System, Inc. (NYSE:CBU), Watts Water Technologies Inc (NYSE:WTS), and II-VI, Inc. (NASDAQ:IIVI). This group of stocks’ market values are similar to RH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBU | 6 | 10495 | 1 |

| CBU | 13 | 23777 | 1 |

| WTS | 22 | 266224 | 7 |

| IIVI | 31 | 200487 | 10 |

| Average | 18 | 125246 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $125 million. That figure was $877 million in RH’s case. II-VI, Inc. (NASDAQ:IIVI) is the most popular stock in this table. On the other hand Brookfield Business Partners L.P. (NYSE:BBU) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks RH (NYSE:RH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on RH as the stock returned 20.3% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.