The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 817 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider Impinj, Inc. (NASDAQ:PI) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

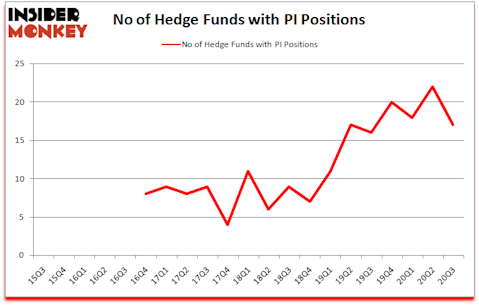

Is PI a good stock to buy now? The best stock pickers were becoming less hopeful. The number of long hedge fund bets were trimmed by 5 lately. Impinj, Inc. (NASDAQ:PI) was in 17 hedge funds’ portfolios at the end of September. The all time high for this statistic is 22. Our calculations also showed that PI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are assumed to be underperforming, outdated financial vehicles of yesteryear. While there are greater than 8000 funds trading today, Our experts look at the top tier of this group, about 850 funds. These hedge fund managers direct the lion’s share of the smart money’s total capital, and by monitoring their finest equity investments, Insider Monkey has revealed various investment strategies that have historically outrun the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

John Overdeck of Two Sigma Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best blue chip stocks to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to go over the recent hedge fund action surrounding Impinj, Inc. (NASDAQ:PI).

Do Hedge Funds Think PI Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from the second quarter of 2020. By comparison, 16 hedge funds held shares or bullish call options in PI a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Daniel Patrick Gibson’s Sylebra Capital Management has the number one position in Impinj, Inc. (NASDAQ:PI), worth close to $115.9 million, amounting to 3.6% of its total 13F portfolio. Sitting at the No. 2 spot is Stephen Perkins of Toronado Partners, with a $38.4 million position; the fund has 10.7% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish consist of Richard SchimeláandáLawrence Sapanski’s Cinctive Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Toronado Partners allocated the biggest weight to Impinj, Inc. (NASDAQ:PI), around 10.7% of its 13F portfolio. Sylebra Capital Management is also relatively very bullish on the stock, dishing out 3.56 percent of its 13F equity portfolio to PI.

Since Impinj, Inc. (NASDAQ:PI) has experienced declining sentiment from the smart money, it’s easy to see that there lies a certain “tier” of fund managers that decided to sell off their full holdings in the third quarter. It’s worth mentioning that Brian Ashford-Russell and Tim Woolley’s Polar Capital dropped the largest investment of the 750 funds tracked by Insider Monkey, totaling close to $5.2 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also said goodbye to its stock, about $2.2 million worth. These moves are important to note, as total hedge fund interest was cut by 5 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Impinj, Inc. (NASDAQ:PI) but similarly valued. These stocks are Camtek LTD. (NASDAQ:CAMT), Orthofix Medical Inc (NASDAQ:OFIX), Calliditas Therapeutics AB (publ) (NASDAQ:CALT), Accelerate Diagnostics Inc (NASDAQ:AXDX), Amyris Inc (NASDAQ:AMRS), Meredith Corporation (NYSE:MDP), and Cara Therapeutics Inc (NASDAQ:CARA). This group of stocks’ market valuations are similar to PI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAMT | 8 | 38114 | 0 |

| OFIX | 17 | 101060 | -2 |

| CALT | 11 | 66043 | -1 |

| AXDX | 13 | 31316 | 0 |

| AMRS | 11 | 124955 | -5 |

| MDP | 18 | 162681 | -2 |

| CARA | 19 | 75686 | 1 |

| Average | 13.9 | 85694 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.9 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $187 million in PI’s case. Cara Therapeutics Inc (NASDAQ:CARA) is the most popular stock in this table. On the other hand Camtek LTD. (NASDAQ:CAMT) is the least popular one with only 8 bullish hedge fund positions. Impinj, Inc. (NASDAQ:PI) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PI is 64.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through December 14th and still beat the market by 15.8 percentage points. Hedge funds were also right about betting on PI as the stock returned 55.8% since the end of Q3 (through 12/14) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Impinj Inc (NASDAQ:PI)

Follow Impinj Inc (NASDAQ:PI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.