Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

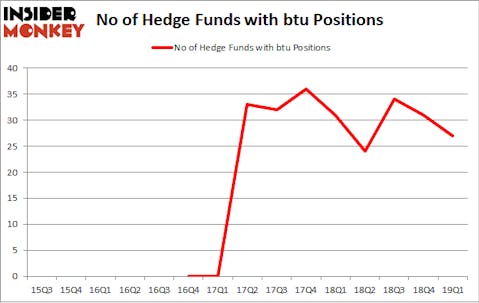

Is Peabody Energy Corporation (NYSE:BTU) undervalued? Hedge funds are turning less bullish. The number of long hedge fund positions shrunk by 4 recently. Our calculations also showed that btu isn’t among the 30 most popular stocks among hedge funds. BTU was in 27 hedge funds’ portfolios at the end of March. There were 31 hedge funds in our database with BTU holdings at the end of the previous quarter.

If you’d ask most traders, hedge funds are assumed to be underperforming, outdated financial tools of years past. While there are greater than 8000 funds in operation at the moment, We look at the crème de la crème of this club, about 750 funds. These hedge fund managers administer the lion’s share of all hedge funds’ total capital, and by monitoring their highest performing stock picks, Insider Monkey has revealed various investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a glance at the recent hedge fund action encompassing Peabody Energy Corporation (NYSE:BTU).

Hedge fund activity in Peabody Energy Corporation (NYSE:BTU)

Heading into the second quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the fourth quarter of 2018. On the other hand, there were a total of 31 hedge funds with a bullish position in BTU a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Peabody Energy Corporation (NYSE:BTU) was held by Elliott Management, which reported holding $797.9 million worth of stock at the end of March. It was followed by Contrarian Capital with a $242 million position. Other investors bullish on the company included Orbis Investment Management, Platinum Asset Management, and Renaissance Technologies.

Seeing as Peabody Energy Corporation (NYSE:BTU) has faced bearish sentiment from the entirety of the hedge funds we track, logic holds that there were a few funds who were dropping their full holdings heading into Q3. Interestingly, Dan Kamensky’s Marble Ridge Capital dropped the biggest investment of the 700 funds followed by Insider Monkey, valued at about $23.4 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund said goodbye to about $4.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Peabody Energy Corporation (NYSE:BTU) but similarly valued. These stocks are Banco Macro SA (NYSE:BMA), Kennedy-Wilson Holdings Inc (NYSE:KW), Core Laboratories N.V. (NYSE:CLB), and RLJ Lodging Trust (NYSE:RLJ). This group of stocks’ market caps are similar to BTU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMA | 16 | 178559 | -1 |

| KW | 14 | 503807 | 1 |

| CLB | 15 | 278565 | 0 |

| RLJ | 21 | 192850 | -4 |

| Average | 16.5 | 288445 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $288 million. That figure was $1578 million in BTU’s case. RLJ Lodging Trust (NYSE:RLJ) is the most popular stock in this table. On the other hand Kennedy-Wilson Holdings Inc (NYSE:KW) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Peabody Energy Corporation (NYSE:BTU) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BTU wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BTU were disappointed as the stock returned -16% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.