Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

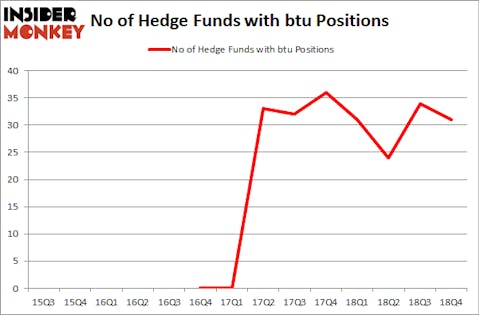

Peabody Energy Corporation (NYSE:BTU) investors should be aware of a decrease in support from the world’s most elite money managers lately. BTU was in 31 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 34 hedge funds in our database with BTU positions at the end of the previous quarter. Our calculations also showed that btu isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are several tools market participants put to use to analyze stocks. A couple of the less known tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best fund managers can outpace the S&P 500 by a solid amount (see the details here).

Let’s review the key hedge fund action surrounding Peabody Energy Corporation (NYSE:BTU).

What does the smart money think about Peabody Energy Corporation (NYSE:BTU)?

At the end of the fourth quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BTU over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Elliott Management was the largest shareholder of Peabody Energy Corporation (NYSE:BTU), with a stake worth $858.5 million reported as of the end of September. Trailing Elliott Management was Contrarian Capital, which amassed a stake valued at $252.1 million. Orbis Investment Management, Platinum Asset Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Because Peabody Energy Corporation (NYSE:BTU) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of hedge funds who sold off their full holdings heading into Q3. Intriguingly, Benjamin A. Smith’s Laurion Capital Management cut the biggest stake of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $16.1 million in stock, and John Horseman’s Horseman Capital Management was right behind this move, as the fund dropped about $9.1 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 3 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Peabody Energy Corporation (NYSE:BTU). These stocks are Radian Group Inc (NYSE:RDN), MKS Instruments, Inc. (NASDAQ:MKSI), Trex Company, Inc. (NYSE:TREX), and Teladoc Health, Inc. (NYSE:TDOC). All of these stocks’ market caps are similar to BTU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDN | 24 | 154880 | 0 |

| MKSI | 30 | 447623 | 5 |

| TREX | 14 | 57358 | -3 |

| TDOC | 19 | 139059 | 0 |

| Average | 21.75 | 199730 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $200 million. That figure was $1751 million in BTU’s case. MKS Instruments, Inc. (NASDAQ:MKSI) is the most popular stock in this table. On the other hand Trex Company, Inc. (NYSE:TREX) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Peabody Energy Corporation (NYSE:BTU) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BTU wasn’t nearly as popular as these 15 stock and hedge funds that were betting on BTU were disappointed as the stock returned 1.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.