The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May and August as this time China pivoted and Trump put more pressure on China by increasing tariffs. Fourth quarter brought optimism to the markets and hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 37.4% through the end of November, vs. a gain of 27.5% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Park Hotels & Resorts Inc. (NYSE:PK), and what that likely means for the prospects of the company and its stock.

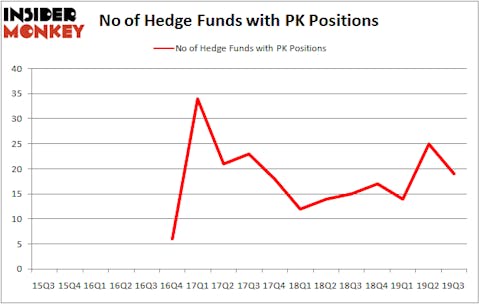

Park Hotels & Resorts Inc. (NYSE:PK) shareholders have witnessed a decrease in support from the world’s most elite money managers recently. Our calculations also showed that PK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are viewed as worthless, outdated investment vehicles of yesteryear. While there are greater than 8000 funds with their doors open at the moment, We hone in on the aristocrats of this group, around 750 funds. Most estimates calculate that this group of people direct the majority of the smart money’s total asset base, and by shadowing their matchless picks, Insider Monkey has unsheathed numerous investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Mason Hawkins of Southeastern Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the new hedge fund action encompassing Park Hotels & Resorts Inc. (NYSE:PK).

What does smart money think about Park Hotels & Resorts Inc. (NYSE:PK)?

Heading into the fourth quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from one quarter earlier. By comparison, 15 hedge funds held shares or bullish call options in PK a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Southeastern Asset Management, managed by Mason Hawkins, holds the biggest position in Park Hotels & Resorts Inc. (NYSE:PK). Southeastern Asset Management has a $267 million position in the stock, comprising 4.7% of its 13F portfolio. Sitting at the No. 2 spot is Millennium Management, led by Israel Englander, holding a $25.4 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism comprise Dmitry Balyasny’s Balyasny Asset Management, Renaissance Technologies and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Southeastern Asset Management allocated the biggest weight to Park Hotels & Resorts Inc. (NYSE:PK), around 4.66% of its 13F portfolio. HighVista Strategies is also relatively very bullish on the stock, designating 0.55 percent of its 13F equity portfolio to PK.

Because Park Hotels & Resorts Inc. (NYSE:PK) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of money managers that elected to cut their positions entirely last quarter. At the top of the heap, David E. Shaw’s D E Shaw dropped the biggest stake of all the hedgies tracked by Insider Monkey, comprising close to $1.4 million in stock, and Louis Bacon’s Moore Global Investments was right behind this move, as the fund cut about $1.4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 6 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Park Hotels & Resorts Inc. (NYSE:PK) but similarly valued. These stocks are EnCana Corporation (NYSE:ECA), EPR Properties (NYSE:EPR), Vipshop Holdings Limited (NYSE:VIPS), and RealPage, Inc. (NASDAQ:RP). This group of stocks’ market valuations are closest to PK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ECA | 25 | 262404 | -7 |

| EPR | 18 | 201024 | -2 |

| VIPS | 22 | 244059 | 5 |

| RP | 31 | 569288 | -2 |

| Average | 24 | 319194 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $319 million. That figure was $378 million in PK’s case. RealPage, Inc. (NASDAQ:RP) is the most popular stock in this table. On the other hand EPR Properties (NYSE:EPR) is the least popular one with only 18 bullish hedge fund positions. Park Hotels & Resorts Inc. (NYSE:PK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately PK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); PK investors were disappointed as the stock returned -5.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.