Is Park Hotels & Resorts Inc. (NYSE:PK) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

Is Park Hotels & Resorts Inc. (NYSE:PK) a sound investment today? The smart money is in a bullish mood. The number of long hedge fund positions inched up by 2 lately. Our calculations also showed that PK isn’t among the 30 most popular stocks among hedge funds. PK was in 17 hedge funds’ portfolios at the end of December. There were 15 hedge funds in our database with PK positions at the end of the previous quarter.

If you’d ask most investors, hedge funds are perceived as slow, old investment tools of the past. While there are over 8000 funds trading at present, Our researchers look at the aristocrats of this club, around 750 funds. These money managers administer most of all hedge funds’ total capital, and by shadowing their top equity investments, Insider Monkey has unearthed a few investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Fred DiSanto of Ancora Advisors

Let’s take a glance at the fresh hedge fund action regarding Park Hotels & Resorts Inc. (NYSE:PK).

How are hedge funds trading Park Hotels & Resorts Inc. (NYSE:PK)?

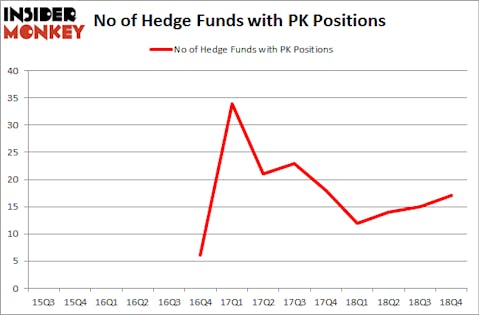

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PK over the last 14 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Southeastern Asset Management held the most valuable stake in Park Hotels & Resorts Inc. (NYSE:PK), which was worth $360.8 million at the end of the third quarter. On the second spot was Ancora Advisors which amassed $24 million worth of shares. Moreover, Renaissance Technologies, D E Shaw, and Two Sigma Advisors were also bullish on Park Hotels & Resorts Inc. (NYSE:PK), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, established the most valuable position in Park Hotels & Resorts Inc. (NYSE:PK). Point72 Asset Management had $11.2 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $0.8 million investment in the stock during the quarter. The other funds with new positions in the stock are David Costen Haley’s HBK Investments and Jeffrey Furber’s AEW Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Park Hotels & Resorts Inc. (NYSE:PK). We will take a look at Helmerich & Payne, Inc. (NYSE:HP), H&R Block, Inc. (NYSE:HRB), Phillips 66 Partners LP (NYSE:PSXP), and EQT Midstream Partners LP (NYSE:EQM). This group of stocks’ market caps are closest to PK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HP | 27 | 428815 | -6 |

| HRB | 18 | 251709 | 0 |

| PSXP | 6 | 11676 | 2 |

| EQM | 8 | 53758 | 0 |

| Average | 14.75 | 186490 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $186 million. That figure was $483 million in PK’s case. Helmerich & Payne, Inc. (NYSE:HP) is the most popular stock in this table. On the other hand Phillips 66 Partners LP (NYSE:PSXP) is the least popular one with only 6 bullish hedge fund positions. Park Hotels & Resorts Inc. (NYSE:PK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on PK as the stock returned 25.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.