Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of NXP Semiconductors NV (NASDAQ:NXPI) and see how the stock is affected by the recent hedge fund activity.

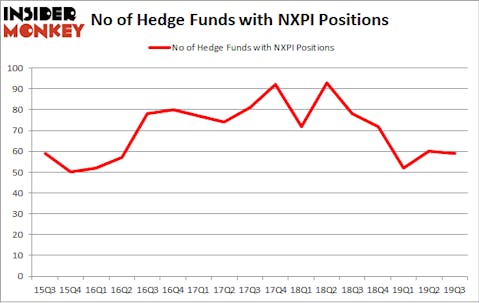

Is NXP Semiconductors NV (NASDAQ:NXPI) the right pick for your portfolio? Hedge funds are becoming less confident. The number of long hedge fund bets fell by 1 lately. Our calculations also showed that NXPI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are dozens of methods investors have at their disposal to assess stocks. A couple of the best methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top investment managers can outpace the market by a significant amount (see the details here).

Noam Gottesman of GLG Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the key hedge fund action surrounding NXP Semiconductors NV (NASDAQ:NXPI).

How have hedgies been trading NXP Semiconductors NV (NASDAQ:NXPI)?

Heading into the fourth quarter of 2019, a total of 59 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -2% from the previous quarter. On the other hand, there were a total of 78 hedge funds with a bullish position in NXPI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Eric W. Mandelblatt and Gaurav Kapadia’s Soroban Capital Partners has the most valuable position in NXP Semiconductors NV (NASDAQ:NXPI), worth close to $551.6 million, corresponding to 7.8% of its total 13F portfolio. Coming in second is Citadel Investment Group, led by Ken Griffin, holding a $259.3 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions comprise Steve Cohen’s Point72 Asset Management, David E. Shaw’s D E Shaw and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Totem Point Management allocated the biggest weight to NXP Semiconductors NV (NASDAQ:NXPI), around 17.87% of its portfolio. Melqart Asset Management is also relatively very bullish on the stock, earmarking 10.41 percent of its 13F equity portfolio to NXPI.

Because NXP Semiconductors NV (NASDAQ:NXPI) has experienced falling interest from hedge fund managers, we can see that there were a few money managers who sold off their entire stakes in the third quarter. Intriguingly, Daniel S. Och (founder)’s Sculptor Capital cut the biggest stake of the 750 funds tracked by Insider Monkey, totaling about $168.7 million in call options. Brandon Haley’s fund, Holocene Advisors, also dropped its call options, about $93.5 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to NXP Semiconductors NV (NASDAQ:NXPI). We will take a look at Atlassian Corporation Plc (NASDAQ:TEAM), AvalonBay Communities Inc (NYSE:AVB), WEC Energy Group, Inc. (NYSE:WEC), and LyondellBasell Industries NV (NYSE:LYB). This group of stocks’ market valuations are similar to NXPI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TEAM | 46 | 2413494 | 10 |

| AVB | 19 | 537344 | -2 |

| WEC | 19 | 383786 | 6 |

| LYB | 31 | 502464 | -14 |

| Average | 28.75 | 959272 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $959 million. That figure was $3381 million in NXPI’s case. Atlassian Corporation Plc (NASDAQ:TEAM) is the most popular stock in this table. On the other hand AvalonBay Communities Inc (NYSE:AVB) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks NXP Semiconductors NV (NASDAQ:NXPI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on NXPI, though not to the same extent, as the stock returned 5.9% during the fourth quarter (through the end of November) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.