The market has been volatile in the last 6 months as the Federal Reserve continued its rate hikes and then abruptly reversed its stance and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q4 and the beginning of Q1. In this article, we analyze what the smart money thinks of NXP Semiconductors NV (NASDAQ:NXPI) and find out how it is affected by hedge funds’ moves.

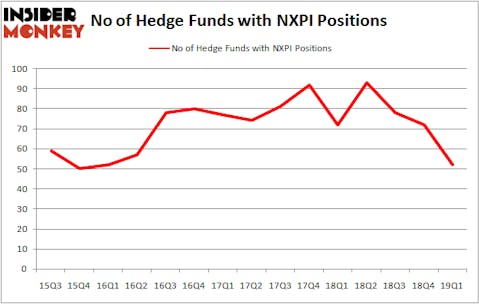

Is NXP Semiconductors NV (NASDAQ:NXPI) a bargain? Investors who are in the know are reducing their bets on the stock. The number of bullish hedge fund positions decreased by 20 in recent months. Our calculations also showed that NXPI isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are assumed to be slow, old investment tools of the past. While there are greater than 8000 funds with their doors open at present, Our researchers choose to focus on the bigwigs of this club, approximately 750 funds. These money managers oversee most of the smart money’s total asset base, and by tailing their inimitable equity investments, Insider Monkey has deciphered a number of investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s review the latest hedge fund action surrounding NXP Semiconductors NV (NASDAQ:NXPI).

What have hedge funds been doing with NXP Semiconductors NV (NASDAQ:NXPI)?

Heading into the second quarter of 2019, a total of 52 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -28% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NXPI over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in NXP Semiconductors NV (NASDAQ:NXPI) was held by Soroban Capital Partners, which reported holding $530.4 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $477.7 million position. Other investors bullish on the company included D E Shaw, OZ Management, and Glenview Capital.

Because NXP Semiconductors NV (NASDAQ:NXPI) has faced declining sentiment from the smart money, logic holds that there exists a select few hedgies that decided to sell off their full holdings by the end of the third quarter. Interestingly, David Costen Haley’s HBK Investments dumped the largest investment of the “upper crust” of funds followed by Insider Monkey, comprising close to $348.1 million in stock, and Matt Sirovich and Jeremy Mindich’s Scopia Capital was right behind this move, as the fund cut about $129 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 20 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as NXP Semiconductors NV (NASDAQ:NXPI) but similarly valued. These stocks are Republic Services, Inc. (NYSE:RSG), Pioneer Natural Resources Company (NYSE:PXD), Halliburton Company (NYSE:HAL), and Agilent Technologies Inc. (NYSE:A). This group of stocks’ market values are closest to NXPI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RSG | 30 | 595673 | 0 |

| PXD | 55 | 1686677 | -7 |

| HAL | 38 | 854658 | 4 |

| A | 41 | 2099188 | 1 |

| Average | 41 | 1309049 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $1309 million. That figure was $3358 million in NXPI’s case. Pioneer Natural Resources Company (NYSE:PXD) is the most popular stock in this table. On the other hand Republic Services, Inc. (NYSE:RSG) is the least popular one with only 30 bullish hedge fund positions. NXP Semiconductors NV (NASDAQ:NXPI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on NXPI as the stock returned 2.8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.