The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at nVent Electric plc (NYSE:NVT) from the perspective of those elite funds.

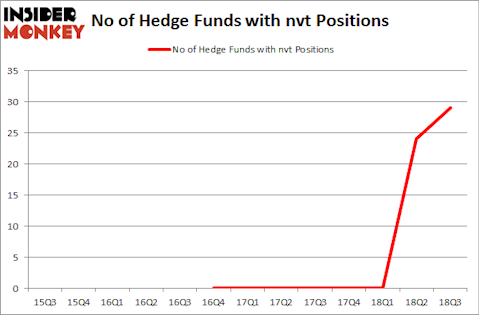

Is nVent Electric plc (NYSE:NVT) a superb investment today? Investors who are in the know are taking a bullish view. The number of long hedge fund bets went up by 5 in recent months. Our calculations also showed that nvt isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s go over the recent hedge fund action encompassing nVent Electric plc (NYSE:NVT).

What have hedge funds been doing with nVent Electric plc (NYSE:NVT)?

#N/A

When looking at the institutional investors followed by Insider Monkey, Nelson Peltz’s Trian Partners has the largest position in nVent Electric plc (NYSE:NVT), worth close to $477 million, corresponding to 4.6% of its total 13F portfolio. On Trian Partners’s heels is Iridian Asset Management, managed by David Cohen and Harold Levy, which holds a $169.4 million position; 1.7% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions comprise Larry Robbins’s Glenview Capital, Phill Gross and Robert Atchinson’s Adage Capital Management and James Dinan’s York Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Ascend Capital, managed by Malcolm Fairbairn, initiated the biggest position in nVent Electric plc (NYSE:NVT). Ascend Capital had $9.5 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also initiated a $8.1 million position during the quarter. The following funds were also among the new NVT investors: Gregg Moskowitz’s Interval Partners, John Burbank’s Passport Capital, and Ian Simm’s Impax Asset Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as nVent Electric plc (NYSE:NVT) but similarly valued. We will take a look at SLM Corp (NASDAQ:SLM), Prosperity Bancshares, Inc. (NYSE:PB), Amarin Corporation plc (NASDAQ:AMRN), and Axis Capital Holdings Limited (NYSE:AXS). All of these stocks’ market caps are closest to NVT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLM | 19 | 596750 | 0 |

| PB | 6 | 73671 | -4 |

| AMRN | 22 | 1152232 | 7 |

| AXS | 21 | 597310 | -3 |

| Average | 17 | 604991 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $605 million. That figure was $1.21 billion in NVT’s case. Amarin Corporation plc (NASDAQ:AMRN) is the most popular stock in this table. On the other hand Prosperity Bancshares, Inc. (NYSE:PB) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks nVent Electric plc (NYSE:NVT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.