It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Total Return Index ETFs returned approximately 27.5% in 2019 (through the end of November). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 37.4% during the same 11-month period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like McDermott International, Inc. (NYSE:MDR).

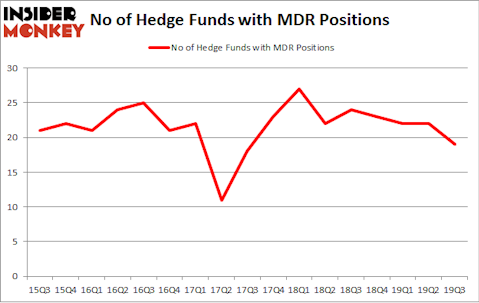

McDermott International, Inc. (NYSE:MDR) has experienced a decrease in enthusiasm from smart money of late. Our calculations also showed that MDR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the new hedge fund action encompassing McDermott International, Inc. (NYSE:MDR).

What does smart money think about McDermott International, Inc. (NYSE:MDR)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the second quarter of 2019. By comparison, 24 hedge funds held shares or bullish call options in MDR a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Luminus Management was the largest shareholder of McDermott International, Inc. (NYSE:MDR), with a stake worth $17.3 million reported as of the end of September. Trailing Luminus Management was AQR Capital Management, which amassed a stake valued at $12.6 million. Millennium Management, Aristeia Capital, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Proxima Capital Management allocated the biggest weight to McDermott International, Inc. (NYSE:MDR), around 2.13% of its 13F portfolio. Luminus Management is also relatively very bullish on the stock, designating 0.5 percent of its 13F equity portfolio to MDR.

Because McDermott International, Inc. (NYSE:MDR) has faced falling interest from hedge fund managers, we can see that there exists a select few hedge funds that elected to cut their entire stakes by the end of the third quarter. It’s worth mentioning that Michael Blitzer’s Kingstown Capital Management dumped the biggest investment of the 750 funds tracked by Insider Monkey, comprising close to $77.3 million in call options. Robert Polak’s fund, Anchor Bolt Capital, also sold off its call options, about $32.7 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to McDermott International, Inc. (NYSE:MDR). These stocks are Owens & Minor, Inc. (NYSE:OMI), Tecnoglass Inc. (NASDAQ:TGLS), Old Second Bancorp Inc. (NASDAQ:OSBC), and Ciner Resources LP (NYSE:CINR). This group of stocks’ market values match MDR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMI | 16 | 38684 | 3 |

| TGLS | 8 | 11898 | 3 |

| OSBC | 9 | 32875 | -3 |

| CINR | 1 | 5077 | 0 |

| Average | 8.5 | 22134 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $52 million in MDR’s case. Owens & Minor, Inc. (NYSE:OMI) is the most popular stock in this table. On the other hand Ciner Resources LP (NYSE:CINR) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks McDermott International, Inc. (NYSE:MDR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately MDR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MDR were disappointed as the stock returned -60.4% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.