While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding McDermott International, Inc. (NYSE:MDR).

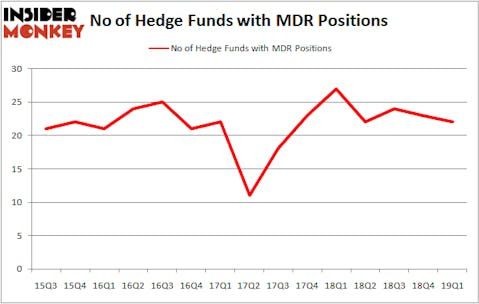

McDermott International, Inc. (NYSE:MDR) has seen a decrease in hedge fund sentiment recently. MDR was in 22 hedge funds’ portfolios at the end of March. There were 23 hedge funds in our database with MDR positions at the end of the previous quarter. Our calculations also showed that MDR isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a gander at the key hedge fund action encompassing McDermott International, Inc. (NYSE:MDR).

Hedge fund activity in McDermott International, Inc. (NYSE:MDR)

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the fourth quarter of 2018. On the other hand, there were a total of 27 hedge funds with a bullish position in MDR a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the number one position in McDermott International, Inc. (NYSE:MDR). AQR Capital Management has a $54.7 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Michael Blitzer of Kingstown Capital Management, with a $44.6 million position; the fund has 9.2% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish consist of Ken Griffin’s Citadel Investment Group, and Robert Pitts’s Steadfast Capital Management.

Due to the fact that McDermott International, Inc. (NYSE:MDR) has faced declining sentiment from the smart money, it’s safe to say that there was a specific group of fund managers who sold off their positions entirely by the end of the third quarter. It’s worth mentioning that Matthew Knauer and Mina Faltas’s Nokota Management cut the largest stake of the “upper crust” of funds watched by Insider Monkey, worth about $15.5 million in stock. Brian Gustavson and Andrew Haley’s fund, 1060 Capital Management, also cut its stock, about $8.2 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to McDermott International, Inc. (NYSE:MDR). We will take a look at Weight Watchers International, Inc. (NASDAQ:WW), Corcept Therapeutics Incorporated (NASDAQ:CORT), Cardiovascular Systems Inc (NASDAQ:CSII), and EnPro Industries, Inc. (NYSE:NPO). This group of stocks’ market valuations resemble MDR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WW | 20 | 210108 | -3 |

| CORT | 18 | 132235 | -1 |

| CSII | 18 | 119140 | -3 |

| NPO | 17 | 146717 | 2 |

| Average | 18.25 | 152050 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $169 million in MDR’s case. Weight Watchers International, Inc. (NASDAQ:WW) is the most popular stock in this table. On the other hand EnPro Industries, Inc. (NYSE:NPO) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks McDermott International, Inc. (NYSE:MDR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MDR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MDR were disappointed as the stock returned -17.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.