How do we determine whether Liberty Broadband Corp (NASDAQ:LBRDK) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

Is Liberty Broadband Corp (NASDAQ:LBRDK) the right investment to pursue these days? The smart money is getting more optimistic. The number of long hedge fund bets moved up by 1 recently. Our calculations also showed that LBRDK isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the fresh hedge fund action regarding Liberty Broadband Corp (NASDAQ:LBRDK).

Hedge fund activity in Liberty Broadband Corp (NASDAQ:LBRDK)

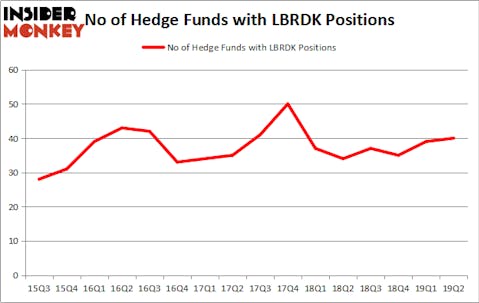

At the end of the second quarter, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards LBRDK over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Coatue Management held the most valuable stake in Liberty Broadband Corp (NASDAQ:LBRDK), which was worth $838.4 million at the end of the second quarter. On the second spot was Soros Fund Management which amassed $755.6 million worth of shares. Moreover, Eagle Capital Management, Stockbridge Partners, and Ashe Capital were also bullish on Liberty Broadband Corp (NASDAQ:LBRDK), allocating a large percentage of their portfolios to this stock.

Now, specific money managers have jumped into Liberty Broadband Corp (NASDAQ:LBRDK) headfirst. Carlson Capital, managed by Clint Carlson, established the most valuable position in Liberty Broadband Corp (NASDAQ:LBRDK). Carlson Capital had $4.7 million invested in the company at the end of the quarter. Steve Pigott’s Fort Baker Capital Management also initiated a $2.5 million position during the quarter. The other funds with brand new LBRDK positions are Michael Gelband’s ExodusPoint Capital, Alec Litowitz and Ross Laser’s Magnetar Capital, and Claes Fornell’s CSat Investment Advisory.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Liberty Broadband Corp (NASDAQ:LBRDK) but similarly valued. These stocks are CBS Corporation (NYSE:CBS), Hess Corporation (NYSE:HES), Ctrip.com International, Ltd. (NASDAQ:CTRP), and Pembina Pipeline Corp (NYSE:PBA). This group of stocks’ market caps are similar to LBRDK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBS | 50 | 1708960 | 4 |

| HES | 35 | 1575949 | 6 |

| CTRP | 27 | 1153907 | -2 |

| PBA | 12 | 158396 | -3 |

| Average | 31 | 1149303 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1149 million. That figure was $3456 million in LBRDK’s case. CBS Corporation (NYSE:CBS) is the most popular stock in this table. On the other hand Pembina Pipeline Corp (NYSE:PBA) is the least popular one with only 12 bullish hedge fund positions. Liberty Broadband Corp (NASDAQ:LBRDK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately LBRDK wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LBRDK were disappointed as the stock returned 0.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.