Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Landstar System, Inc. (NASDAQ:LSTR).

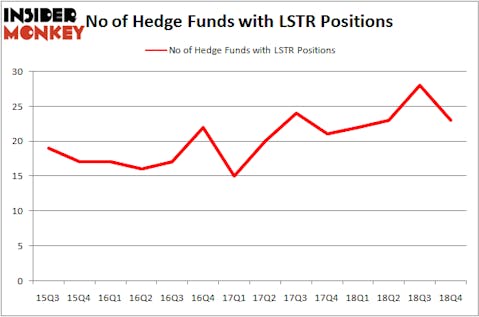

Landstar System, Inc. (NASDAQ:LSTR) was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2018. LSTR shareholders have witnessed a decrease in enthusiasm from smart money lately. There were 28 hedge funds in our database with LSTR positions at the end of the previous quarter. Our calculations also showed that LSTR isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the new hedge fund action regarding Landstar System, Inc. (NASDAQ:LSTR).

How have hedgies been trading Landstar System, Inc. (NASDAQ:LSTR)?

Heading into the first quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from the previous quarter. By comparison, 22 hedge funds held shares or bullish call options in LSTR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Landstar System, Inc. (NASDAQ:LSTR), with a stake worth $79.9 million reported as of the end of September. Trailing Royce & Associates was AQR Capital Management, which amassed a stake valued at $29.3 million. Renaissance Technologies, GLG Partners, and Gotham Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Landstar System, Inc. (NASDAQ:LSTR) has witnessed falling interest from the smart money, it’s easy to see that there is a sect of funds that slashed their positions entirely last quarter. Intriguingly, Peter Muller’s PDT Partners dropped the largest position of the 700 funds monitored by Insider Monkey, comprising close to $3.8 million in stock. Malcolm Fairbairn’s fund, Ascend Capital, also dumped its stock, about $2.1 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 5 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Landstar System, Inc. (NASDAQ:LSTR). We will take a look at FibroGen Inc (NASDAQ:FGEN), Hospitality Properties Trust (NASDAQ:HPT), ALLETE Inc (NYSE:ALE), and PBF Energy Inc (NYSE:PBF). All of these stocks’ market caps are closest to LSTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FGEN | 20 | 221726 | 3 |

| HPT | 16 | 70399 | 0 |

| ALE | 18 | 207421 | 1 |

| PBF | 18 | 393653 | -11 |

| Average | 18 | 223300 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $223 million. That figure was $202 million in LSTR’s case. FibroGen Inc (NASDAQ:FGEN) is the most popular stock in this table. On the other hand Hospitality Properties Trust (NASDAQ:HPT) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Landstar System, Inc. (NASDAQ:LSTR) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on LSTR, though not to the same extent, as the stock returned 17.4% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.