Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Kulicke and Soffa Industries Inc. (NASDAQ:KLIC).

Is Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) an outstanding investment right now? Money managers are in an optimistic mood. The number of bullish hedge fund positions moved up by 2 recently. Our calculations also showed that KLIC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Chuck Royce of Royce & Associates

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the new hedge fund action surrounding Kulicke and Soffa Industries Inc. (NASDAQ:KLIC).

Hedge fund activity in Kulicke and Soffa Industries Inc. (NASDAQ:KLIC)

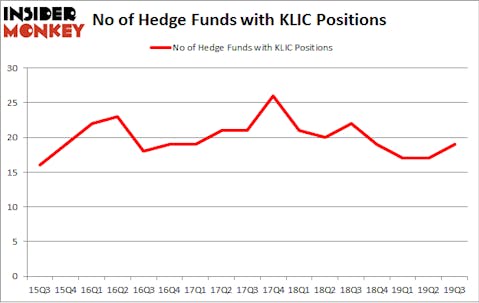

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards KLIC over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in Kulicke and Soffa Industries Inc. (NASDAQ:KLIC), which was worth $75.6 million at the end of the third quarter. On the second spot was Whale Rock Capital Management which amassed $37.6 million worth of shares. Renaissance Technologies, D E Shaw, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Valueworks LLC allocated the biggest weight to Kulicke and Soffa Industries Inc. (NASDAQ:KLIC), around 3.54% of its 13F portfolio. Nishkama Capital is also relatively very bullish on the stock, setting aside 2.42 percent of its 13F equity portfolio to KLIC.

Consequently, specific money managers were leading the bulls’ herd. Intrinsic Edge Capital, managed by Mark Coe, assembled the most outsized position in Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). Intrinsic Edge Capital had $7.5 million invested in the company at the end of the quarter. Steven Baughman’s Divisar Capital also initiated a $6.5 million position during the quarter. The other funds with brand new KLIC positions are Ravee Mehta’s Nishkama Capital and Bruce Kovner’s Caxton Associates.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) but similarly valued. These stocks are Uniqure NV (NASDAQ:QURE), Yunji Inc. (NASDAQ:YJ), American Finance Trust, Inc. (NASDAQ:AFIN), and Plantronics, Inc. (NYSE:PLT). All of these stocks’ market caps are similar to KLIC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QURE | 38 | 538224 | 4 |

| YJ | 3 | 5331 | -1 |

| AFIN | 8 | 11654 | 4 |

| PLT | 11 | 97331 | -7 |

| Average | 15 | 163135 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was $256 million in KLIC’s case. Uniqure NV (NASDAQ:QURE) is the most popular stock in this table. On the other hand Yunji Inc. (NASDAQ:YJ) is the least popular one with only 3 bullish hedge fund positions. Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on KLIC, though not to the same extent, as the stock returned 6.9% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.