You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

KKR & Co Inc. (NYSE:KKR) has experienced an increase in support from the world’s most elite money managers in recent months. KKR was in 31 hedge funds’ portfolios at the end of the third quarter of 2018. There were 24 hedge funds in our database with KKR holdings at the end of the previous quarter. Our calculations also showed that KKR isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are viewed as underperforming, old investment vehicles of yesteryear. While there are more than 8,000 funds trading at the moment, Our experts choose to focus on the upper echelon of this group, approximately 700 funds. These money managers control bulk of the smart money’s total asset base, and by monitoring their matchless stock picks, Insider Monkey has figured out a few investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to view the fresh hedge fund action encompassing KKR & Co Inc. (NYSE:KKR).

How are hedge funds trading KKR & Co Inc. (NYSE:KKR)?

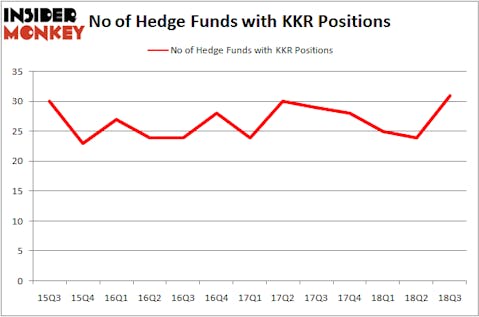

Heading into the fourth quarter of 2018, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in KKR over the last 13 quarters. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

The largest stake in KKR & Co Inc. (NYSE:KKR) was held by ValueAct Capital, which reported holding $1355.3 million worth of stock at the end of September. It was followed by Akre Capital Management with a $272.7 million position. Other investors bullish on the company included Egerton Capital Limited, Pzena Investment Management, and Ariel Investments.

As aggregate interest increased, some big names were leading the bulls’ herd. Egerton Capital Limited, managed by John Armitage, initiated the largest position in KKR & Co Inc. (NYSE:KKR). Egerton Capital Limited had $266.3 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also made a $51.2 million investment in the stock during the quarter. The following funds were also among the new KKR investors: Matthew Hulsizer’s PEAK6 Capital Management, William Hyatt’s Hudson Way Capital Management, and Clint Carlson’s Carlson Capital.

Let’s also examine hedge fund activity in other stocks similar to KKR & Co Inc. (NYSE:KKR). These stocks are Agilent Technologies Inc. (NYSE:A), Stanley Black & Decker, Inc. (NYSE:SWK), Liberty Global plc (NASDAQ:LBTYA), and NetApp Inc. (NASDAQ:NTAP). All of these stocks’ market caps match KKR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| A | 40 | 2814048 | -5 |

| SWK | 27 | 421148 | -5 |

| LBTYA | 39 | 1702341 | 5 |

| NTAP | 27 | 886361 | 0 |

| Average | 33.25 | 1455975 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.46 billion. That figure was $2.77 billion in KKR’s case. Agilent Technologies Inc. (NYSE:A) is the most popular stock in this table. On the other hand Stanley Black & Decker, Inc. (NYSE:SWK) is the least popular one with only 27 bullish hedge fund positions. KKR & Co Inc. (NYSE:KKR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard A might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.