At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

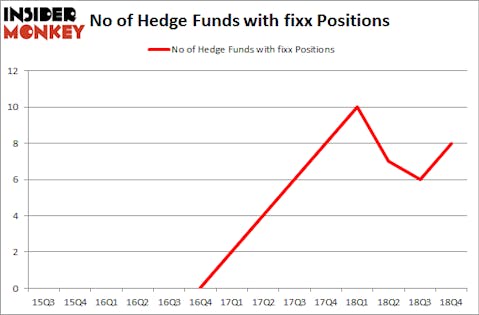

Homology Medicines, Inc. (NASDAQ:FIXX) has seen an increase in enthusiasm from smart money in recent months. FIXX was in 8 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 6 hedge funds in our database with FIXX holdings at the end of the previous quarter. Our calculations also showed that fixx isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the key hedge fund action encompassing Homology Medicines, Inc. (NASDAQ:FIXX).

Hedge fund activity in Homology Medicines, Inc. (NASDAQ:FIXX)

At Q4’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FIXX over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, James E. Flynn’s Deerfield Management has the biggest position in Homology Medicines, Inc. (NASDAQ:FIXX), worth close to $116.9 million, accounting for 4.7% of its total 13F portfolio. The second largest stake is held by Vivo Capital, led by Albert Cha and Frank Kung, holding a $25.9 million position; the fund has 3.3% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism contain Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Eli Casdin’s Casdin Capital and Brian Ashford-Russell and Tim Woolley’s Polar Capital.

As one would reasonably expect, key money managers were breaking ground themselves. Vivo Capital, managed by Albert Cha and Frank Kung, initiated the most valuable position in Homology Medicines, Inc. (NASDAQ:FIXX). Vivo Capital had $25.9 million invested in the company at the end of the quarter. Brian Ashford-Russell and Tim Woolley’s Polar Capital also made a $2.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Julian Robertson’s Tiger Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Homology Medicines, Inc. (NASDAQ:FIXX) but similarly valued. These stocks are Skyline Champion Corporation (NYSE:SKY), Rambus Inc. (NASDAQ:RMBS), New York Mortgage Trust, Inc. (NASDAQ:NYMT), and NIC Inc. (NASDAQ:EGOV). All of these stocks’ market caps resemble FIXX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SKY | 23 | 232733 | 0 |

| RMBS | 13 | 58672 | 2 |

| NYMT | 9 | 4241 | 2 |

| EGOV | 18 | 68161 | 0 |

| Average | 15.75 | 90952 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $164 million in FIXX’s case. Skyline Champion Corporation (NYSE:SKY) is the most popular stock in this table. On the other hand New York Mortgage Trust, Inc. (NASDAQ:NYMT) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Homology Medicines, Inc. (NASDAQ:FIXX) is even less popular than NYMT. Hedge funds dodged a bullet by taking a bearish stance towards FIXX. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FIXX wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); FIXX investors were disappointed as the stock returned -2.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.