Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Gilat Satellite Networks Ltd. (NASDAQ:GILT).

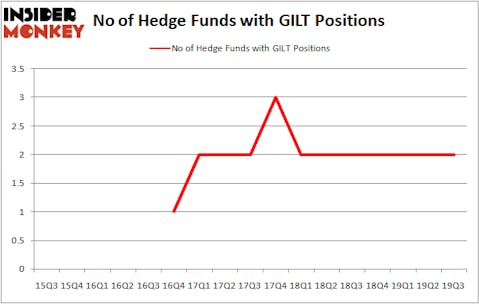

Gilat Satellite Networks Ltd. (NASDAQ:GILT) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 2 hedge funds’ portfolios at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Forterra, Inc. (NASDAQ:FRTA), Matrix Service Co (NASDAQ:MTRX), and Nexgen Energy Ltd. (NYSE:NXE) to gather more data points. Our calculations also showed that GILT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are viewed as slow, outdated financial vehicles of years past. While there are more than 8000 funds in operation at present, We choose to focus on the leaders of this group, approximately 750 funds. These money managers have their hands on bulk of the smart money’s total asset base, and by paying attention to their best stock picks, Insider Monkey has unearthed a number of investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Let’s analyze the latest hedge fund action surrounding Gilat Satellite Networks Ltd. (NASDAQ:GILT).

How are hedge funds trading Gilat Satellite Networks Ltd. (NASDAQ:GILT)?

At the end of the third quarter, a total of 2 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards GILT over the last 17 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Renaissance Technologies founded by Jim Simons was the largest shareholder of Gilat Satellite Networks Ltd. (NASDAQ:GILT), with a stake worth $24.7 million reported as of the end of September. Trailing Renaissance Technologies was Noked Capital, which amassed a stake valued at $0.8 million.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks similar to Gilat Satellite Networks Ltd. (NASDAQ:GILT). We will take a look at Forterra, Inc. (NASDAQ:FRTA), Matrix Service Co (NASDAQ:MTRX), Nexgen Energy Ltd. (NYSE:NXE), and The Rubicon Project Inc (NYSE:RUBI). All of these stocks’ market caps are closest to GILT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRTA | 13 | 73440 | 2 |

| MTRX | 19 | 28483 | 5 |

| NXE | 8 | 20023 | 0 |

| RUBI | 20 | 77237 | 4 |

| Average | 15 | 49796 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $50 million. That figure was $26 million in GILT’s case. The Rubicon Project Inc (NYSE:RUBI) is the most popular stock in this table. On the other hand Nexgen Energy Ltd. (NYSE:NXE) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Gilat Satellite Networks Ltd. (NASDAQ:GILT) is even less popular than NXE. Hedge funds dodged a bullet by taking a bearish stance towards GILT. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately GILT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); GILT investors were disappointed as the stock returned -0.2% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.