The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th, about a month before the elections. We at Insider Monkey have made an extensive database of more than 817 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Freeport-McMoRan Inc. (NYSE:FCX) based on those filings.

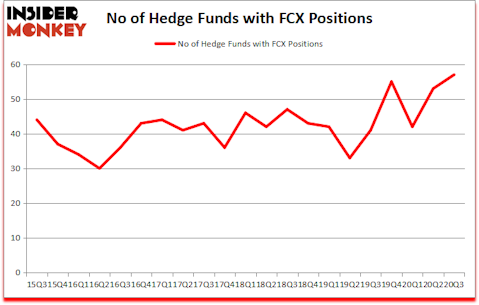

Is Freeport-McMoRan (FCX) a good stock to buy now? Hedge funds were betting on the stock. The number of long hedge fund bets moved up by 4 recently. Freeport-McMoRan Inc. (NYSE:FCX) was in 57 hedge funds’ portfolios at the end of September. The all time high for this statistics is 55. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that FCX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are assumed to be slow, outdated financial vehicles of yesteryear. While there are over 8000 funds trading today, Our researchers choose to focus on the bigwigs of this group, about 850 funds. These investment experts control the majority of all hedge funds’ total capital, and by tailing their finest stock picks, Insider Monkey has spotted several investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Kerr Neilson of Platinum Asset Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to take a gander at the fresh hedge fund action encompassing Freeport-McMoRan Inc. (NYSE:FCX).

How have hedgies been trading Freeport-McMoRan Inc. (NYSE:FCX)?

At the end of September, a total of 57 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. By comparison, 41 hedge funds held shares or bullish call options in FCX a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Fisher Asset Management held the most valuable stake in Freeport-McMoRan Inc. (NYSE:FCX), which was worth $632.7 million at the end of the third quarter. On the second spot was Lansdowne Partners which amassed $168 million worth of shares. Slate Path Capital, Duquesne Capital, and Platinum Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Prince Street Capital Management allocated the biggest weight to Freeport-McMoRan Inc. (NYSE:FCX), around 7.53% of its 13F portfolio. Lansdowne Partners is also relatively very bullish on the stock, designating 6.75 percent of its 13F equity portfolio to FCX.

As aggregate interest increased, some big names have jumped into Freeport-McMoRan Inc. (NYSE:FCX) headfirst. Impala Asset Management, managed by Robert Bishop, assembled the most valuable position in Freeport-McMoRan Inc. (NYSE:FCX). Impala Asset Management had $24.3 million invested in the company at the end of the quarter. Ken Heebner’s Capital Growth Management also made a $12.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Gilchrist Berg’s Water Street Capital, Louis Bacon’s Moore Global Investments, and Scott Bessent’s Key Square Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Freeport-McMoRan Inc. (NYSE:FCX) but similarly valued. We will take a look at Phillips 66 (NYSE:PSX), TELUS Corporation (NYSE:TU), Nutrien Ltd. (NYSE:NTR), Yum China Holdings, Inc. (NYSE:YUMC), DTE Energy Company (NYSE:DTE), Kellogg Company (NYSE:K), and Southwest Airlines Co. (NYSE:LUV). This group of stocks’ market valuations resemble FCX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PSX | 27 | 203563 | -15 |

| TU | 12 | 163923 | -3 |

| NTR | 26 | 550380 | 4 |

| YUMC | 39 | 1096345 | 4 |

| DTE | 28 | 232166 | 4 |

| K | 35 | 483978 | 2 |

| LUV | 51 | 744922 | -5 |

| Average | 31.1 | 496468 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.1 hedge funds with bullish positions and the average amount invested in these stocks was $496 million. That figure was $1579 million in FCX’s case. Southwest Airlines Co. (NYSE:LUV) is the most popular stock in this table. On the other hand TELUS Corporation (NYSE:TU) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Freeport-McMoRan Inc. (NYSE:FCX) is more popular among hedge funds. Our overall hedge fund sentiment score for FCX is 89. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 31.6% in 2020 through December 2nd but still managed to beat the market by 16 percentage points. Hedge funds were also right about betting on FCX as the stock returned 54% since the end of September (through 12/2) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Freeport-Mcmoran Inc (NYSE:FCX)

Follow Freeport-Mcmoran Inc (NYSE:FCX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.