Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying for a while now that the current market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the third quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) changed recently.

Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) has seen an increase in enthusiasm from smart money of late. Our calculations also showed that FOMX isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a lot of gauges stock market investors have at their disposal to grade stocks. Two of the less utilized gauges are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can outclass the market by a solid amount (see the details here).

Let’s take a glance at the recent hedge fund action surrounding Foamix Pharmaceuticals Ltd (NASDAQ:FOMX).

Hedge fund activity in Foamix Pharmaceuticals Ltd (NASDAQ:FOMX)

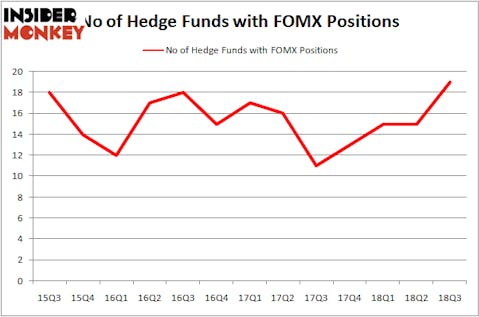

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards FOMX over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, OrbiMed Advisors held the most valuable stake in Foamix Pharmaceuticals Ltd (NASDAQ:FOMX), which was worth $29.8 million at the end of the third quarter. On the second spot was Great Point Partners which amassed $23.1 million worth of shares. Moreover, Perceptive Advisors, Point72 Asset Management, and Millennium Management were also bullish on Foamix Pharmaceuticals Ltd (NASDAQ:FOMX), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key money managers were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, assembled the most outsized position in Foamix Pharmaceuticals Ltd (NASDAQ:FOMX). Point72 Asset Management had $6.6 million invested in the company at the end of the quarter. Michael Castor’s Sio Capital also made a $4.4 million investment in the stock during the quarter. The other funds with brand new FOMX positions are Ori Hershkovitz’s Nexthera Capital, Jonathan Auerbach’s Hound Partners, and Louis Bacon’s Moore Global Investments.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) but similarly valued. We will take a look at Neuberger Berman Real Estate Securities Income Fund, Inc. (NYSE:NRO), Town Sports International Holdings, Inc. (NASDAQ:CLUB), Bluerock Residential Growth REIT Inc (NYSEMKT:BRG), and DASAN Zhone Solutions, Inc. (NASDAQ:DZSI). All of these stocks’ market caps are similar to FOMX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NRO | 3 | 525 | 2 |

| CLUB | 12 | 110798 | 0 |

| BRG | 5 | 14011 | -2 |

| DZSI | 2 | 2428 | 0 |

| Average | 5.5 | 31941 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $120 million in FOMX’s case. Town Sports International Holdings, Inc. (NASDAQ:CLUB) is the most popular stock in this table. On the other hand DASAN Zhone Solutions, Inc. (NASDAQ:DZSI) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.