“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Hedge fund interest in Five Point Holdings, LLC (NYSE:FPH) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cray Inc. (NASDAQ:CRAY), Liberty Tripadvisor Holdings Inc (NASDAQ:LTRPA), and Methode Electronics Inc. (NYSE:MEI) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action encompassing Five Point Holdings, LLC (NYSE:FPH).

What have hedge funds been doing with Five Point Holdings, LLC (NYSE:FPH)?

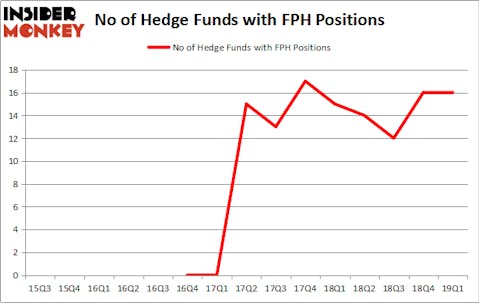

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in FPH a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Five Point Holdings, LLC (NYSE:FPH) was held by Third Avenue Management, which reported holding $106 million worth of stock at the end of March. It was followed by Anchorage Advisors with a $71.2 million position. Other investors bullish on the company included Long Pond Capital, Glendon Capital Management, and Kingstown Capital Management.

Seeing as Five Point Holdings, LLC (NYSE:FPH) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there were a few hedge funds that slashed their positions entirely in the third quarter. Intriguingly, Bruce J. Richards and Louis Hanover’s Marathon Asset Management dropped the largest investment of the “upper crust” of funds monitored by Insider Monkey, worth about $8.1 million in stock. Jim Roumell’s fund, Roumell Asset Management, also dropped its stock, about $1.7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Five Point Holdings, LLC (NYSE:FPH) but similarly valued. These stocks are Cray Inc. (NASDAQ:CRAY), Liberty Tripadvisor Holdings Inc (NASDAQ:LTRPA), Methode Electronics Inc. (NYSE:MEI), and Domo Inc. (NASDAQ:DOMO). All of these stocks’ market caps are closest to FPH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRAY | 19 | 71237 | 5 |

| LTRPA | 23 | 279113 | 3 |

| MEI | 10 | 82822 | 3 |

| DOMO | 21 | 185107 | 8 |

| Average | 18.25 | 154570 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $273 million in FPH’s case. Liberty Tripadvisor Holdings Inc (NASDAQ:LTRPA) is the most popular stock in this table. On the other hand Methode Electronics Inc. (NYSE:MEI) is the least popular one with only 10 bullish hedge fund positions. Five Point Holdings, LLC (NYSE:FPH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FPH wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); FPH investors were disappointed as the stock returned -2.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.