At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Five Point Holdings, LLC (NYSE:FPH) makes for a good investment right now.

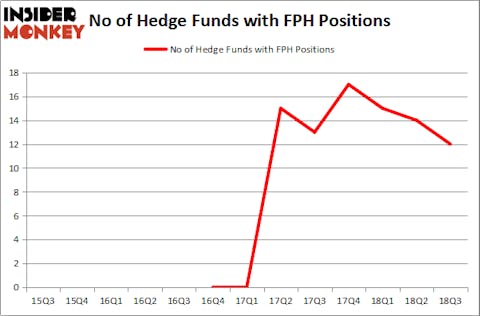

Five Point Holdings, LLC (NYSE:FPH) investors should be aware of a decrease in hedge fund interest recently. FPH was in 12 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with FPH positions at the end of the previous quarter. Our calculations also showed that FPH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to the beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action encompassing Five Point Holdings, LLC (NYSE:FPH).

What have hedge funds been doing with Five Point Holdings, LLC (NYSE:FPH)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in FPH at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Martin Whitman’s Third Avenue Management has the most valuable position in Five Point Holdings, LLC (NYSE:FPH), worth close to $96.2 million, comprising 5.4% of its total 13F portfolio. The second most bullish fund manager is Kevin Michael Ulrich and Anthony Davis of Anchorage Advisors, with a $92.9 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism contain John Khoury’s Long Pond Capital, Matthew Barrett’s Glendon Capital Management and Michael Blitzer’s Kingstown Capital Management.

Judging by the fact that Five Point Holdings, LLC (NYSE:FPH) has experienced declining sentiment from the smart money, logic holds that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, Wayne Cooperman’s Cobalt Capital Management dumped the biggest position of all the hedgies monitored by Insider Monkey, comprising about $5.8 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund dumped about $0.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Five Point Holdings, LLC (NYSE:FPH) but similarly valued. We will take a look at 1st Source Corporation (NASDAQ:SRCE), Chesapeake Utilities Corporation (NYSE:CPK), Corporacion America Airports SA (NYSE:CAAP), and Hertz Global Holdings, Inc. (NYSE:HTZ). This group of stocks’ market valuations resemble FPH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRCE | 8 | 28210 | 1 |

| CPK | 9 | 31141 | -1 |

| CAAP | 14 | 48444 | 1 |

| HTZ | 26 | 961932 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $267 million. That figure was $294 million in FPH’s case. Hertz Global Holdings, Inc. (NYSE:HTZ) is the most popular stock in this table. On the other hand 1st Source Corporation (NASDAQ:SRCE) is the least popular one with only 8 bullish hedge fund positions. Five Point Holdings, LLC (NYSE:FPH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HTZ might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.